The annual Partech Africa Tech Venture Capital report offers valuable insights into the evolution of the African tech ecosystem.

The 2023 edition reveals a significant funding slowdown aligned with global VC trends, yet highlights areas of resilience.

Here are the key takeaways.

Halved Funding Reflects Global Downturn

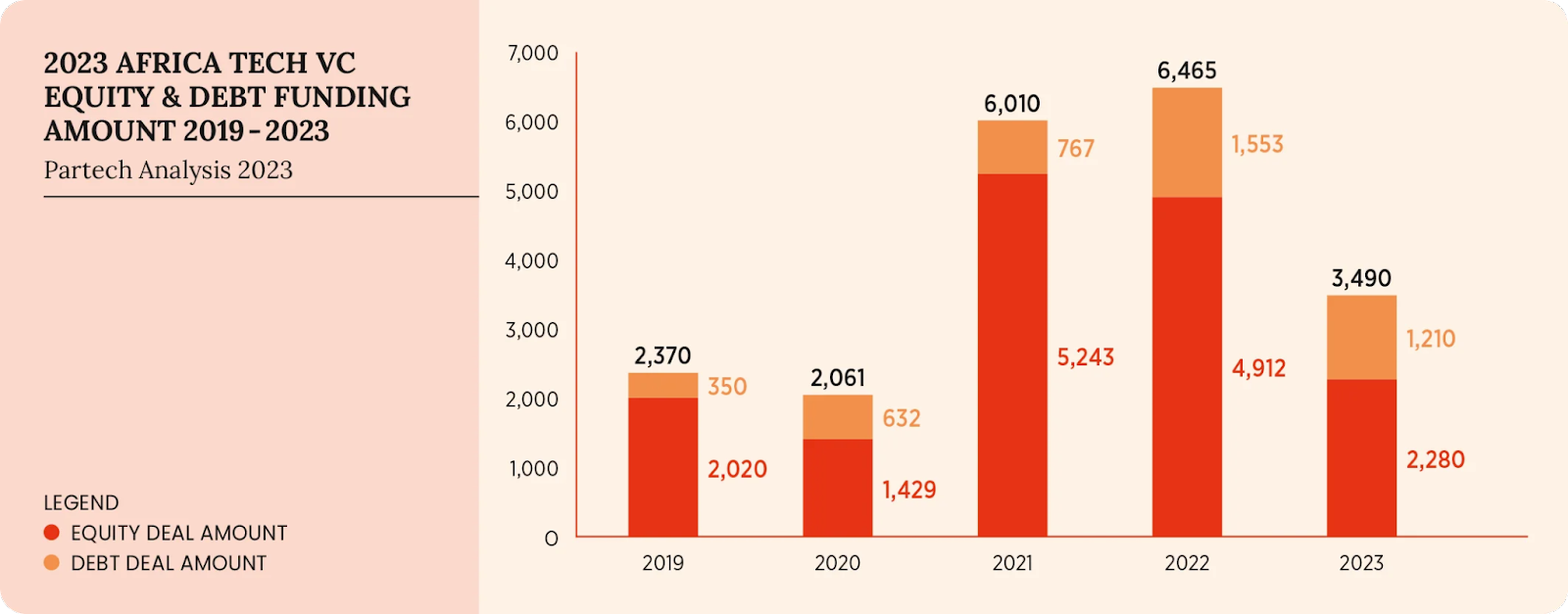

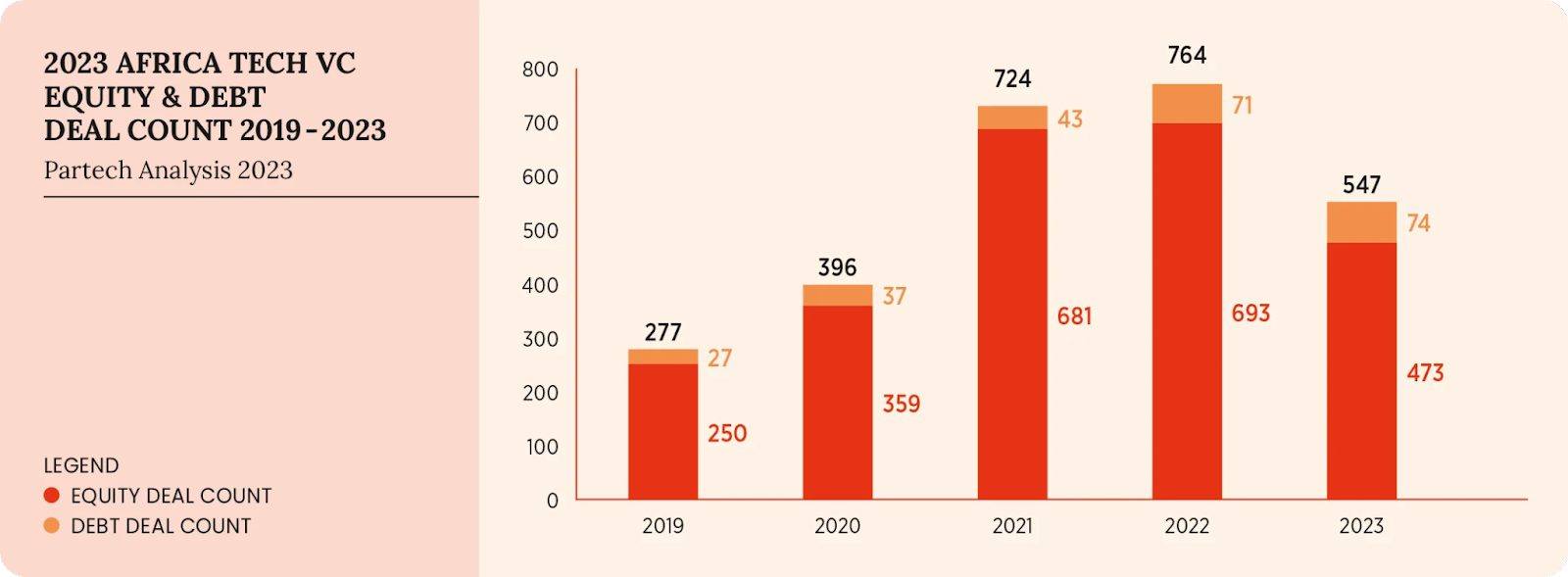

In 2023, African startups raised $3.5B, a 46% annual drop, spread across 547 deals (-28%). Equity specifically saw a 50% funding decrease.

This mirrors the global VC funding crunch as investors became more cautious. However, Africa still captivated over 500 investors, proving continued strong interest.

Drop Seen at All Funding Stages

The report shows drops across all funding stages, but the largest was in growth rounds (-31% ticket average). Seed and Series A shrank moderately (8-16%), while Series B held steady.

This indicates investors focused on supporting existing portfolio companies rather than new investments.

Top 4 Markets Still Lead, With Shifts

The African “big four” markets —South Africa, Nigeria, Egypt, and Kenya—still dominate, securing 79% of deals. However, their deal share fell somewhat (from 77%), signaling increasing activity across the continent.

South Africa took first place by total equity raised at $548M. Yet Kenya captured the top spot for overall funding at $719M thanks to major debt financing. So these two nations currently lead Africa’s tech funding.

Nigeria persisted as #1 by deal count, despite its equity funding being halved. Meanwhile, Egypt took the biggest hit among the top four, with equity deals plummeting 58%.

Francophone Rising

Encouragingly, 52% of African countries saw a tech investment, up from 46% in 2022. Francophone Africa enjoyed substantial growth taking 15% of equity (up from 11%) across 20% of deals. This indicates strengthened VC attention beyond the major four tech hubs.

Also Read: Francophone Africa – An Emerging Startup Powerhouse

Fintech Retains Funding Crown

As in previous years, fintech ranked first in both deals (113) and total equity funding ($852M).

E-commerce and cleantech tied for second place with 13% shares each. Fintech’s dominance shows Africa’s immense need for financial inclusion and payment solutions.

Funding to Women Founders Growing

Startups with female founders raised 25% of equity deals, up 3 percentage points from 2022. They also secured $392M in equity, representing 17% of total equity versus 13% last year. While still low relative to the population, VC backing for women tech leaders gained meaningful ground.

Debt Emerges as Complement to Equity

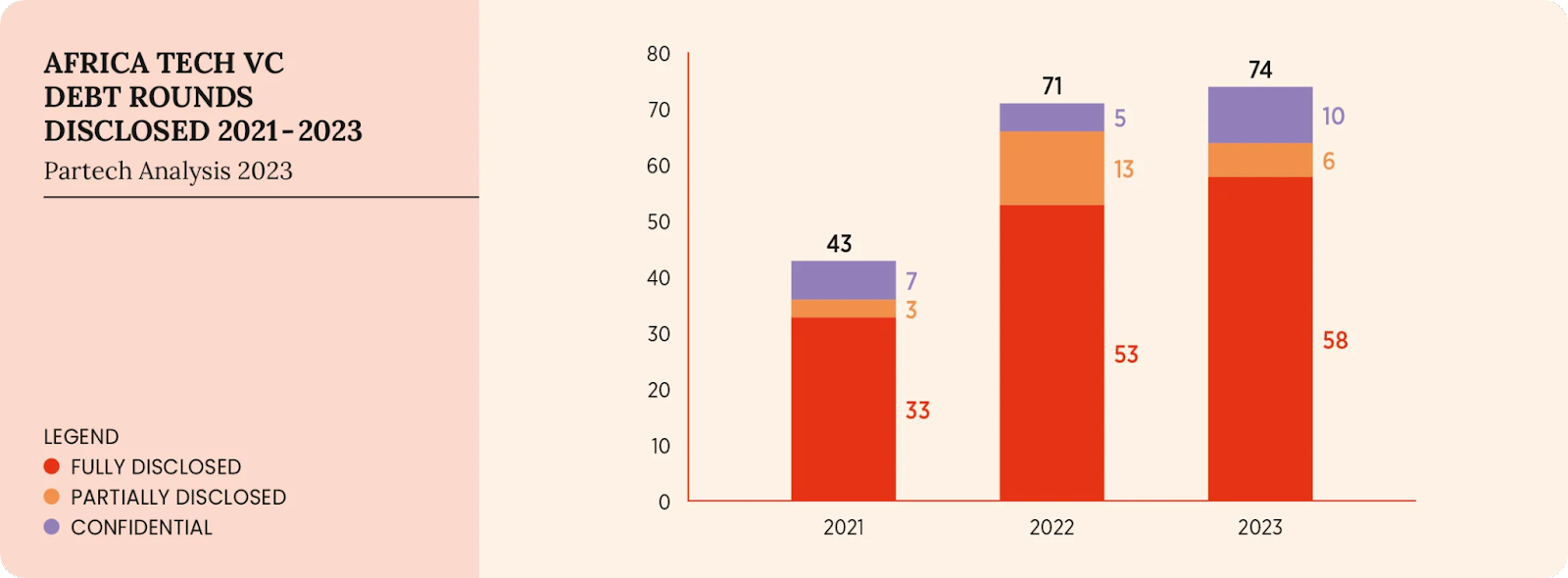

The report highlights debt’s increasing relevance, making up 35% of total funding versus just 24% in 2022.

Kenya led debt financing with a 32% share, focused heavily on cleantech and fintech companies.

As equity tightens, debt provides a viable capital alternative for maturing African startups.

In summary, while the Africa tech funding environment grew markedly more challenging in 2023, the sector appears to be weathering the storm.

Key players retained respectable funding levels given the climate, investors continued backing a breadth of markets and founders, and debt helped cushion the equity slowdown.

The Partech report suggests cautious optimism for African tech growth returning post-downturn. Key metrics like deal count and women’s funding underscore the industry’s underlying momentum.

Want to learn more about investment trends and access opportunities in Africa? Download the Daba application from your app stores today!

Leave a Reply