Investing in the banking industry offers numerous advantages, as highlighted by BICICI’s (Banque Internationale pour le Commerce et l’Industrie de la Côte d’Ivoire) impressive financial performance in the first quarter of 2024.

Despite global economic challenges, the banking sector demonstrates resilience and robust growth potential.

Here are the key positives for investing in the banking industry based on BICICI’s Q1 2024 financial report.

1. Strong Financial Growth

Net Banking Income (NBI) Growth:

BRVM-listed BICICI saw its NBI surge by 38.2%, from 12 billion FCFA in Q1 2023 to 16.6 billion FCFA in Q1 2024. This significant increase highlights the bank’s ability to generate higher income from its core operations, indicating strong financial health and profitability.

Substantial Increase in Operating Income Before Tax:

The bank’s operating income before tax grew by an impressive 276.6%, reaching 7,514 million FCFA in Q1 2024, up from 1,995 million FCFA in Q1 2023. This remarkable growth underscores effective cost management and operational efficiency.

Robust Growth in Net Profit:

BICICI’s net profit rose by 244.2%, from 1,892 million FCFA in Q1 2023 to 6,512 million FCFA in Q1 2024. This substantial increase in profitability enhances shareholder value and indicates a strong return on investment.

2. Expanding Loan Portfolio

Increase in Net Loans to Customers:

The 5.2% growth in net loans to customers, from 463,969 million FCFA in March 2023 to 488,237 million FCFA in March 2024, reflects the bank’s ability to expand its lending operations.

This growth indicates a strong demand for credit and effective risk management, essential for sustainable growth in the banking sector.

3. Resilience Amid Economic Challenges

Adaptability to Global Economic Conditions:

Despite the global economic challenges, including the repercussions of the war in Ukraine, tightening monetary policies, and persistent inflation, BICICI demonstrated resilience.

The bank’s ability to navigate these challenges and achieve substantial growth underscores the stability and robustness of the banking sector.

4. Positive Future Outlook

Expected Continuation of Growth Trends:

Based on the current commercial dynamics, BICICI is expected to maintain its positive trend into the second quarter of 2024.

The anticipated improvement in returns on capital and portfolio investments, combined with effective cost control and risk management, positions the bank for continued growth and profitability.

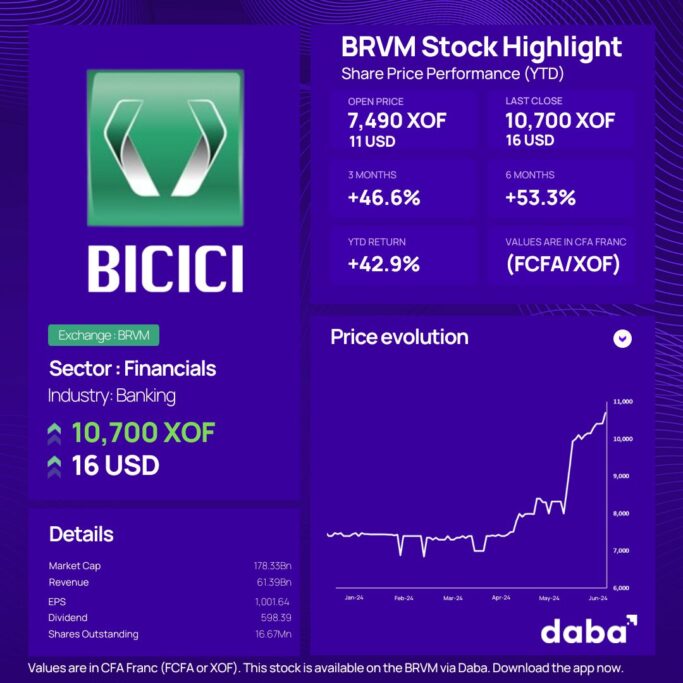

BICICI Stock Performance

In tandem with its impressive financial performance, BICICI has seen its share price skyrocket by an impressive 46.6% over the past three months.

Starting at 7,490 XOF (11 USD), the stock has climbed to 10,700 XOF (16 USD), delivering a year-to-date return of 42.9% as of Friday, June 21, 2024.

This remarkable growth reflects the robust performance and strategic advancements in the francophone West African banking industry. Investors are seeing substantial returns, and the momentum shows no signs of slowing down.

Also Read: Ivorian bank BICI grows profit by 35% to $27m in 2023

Conclusion

Investing in the banking industry offers numerous benefits, as evidenced by BICICI’s Q1 2024 financial performance. The strong financial growth, expanding loan portfolio, resilience amid economic challenges, and positive future outlook make the banking sector an attractive investment opportunity.

BICICI’s impressive results highlight the potential for substantial returns and long-term value creation, making the banking industry a smart choice for investors seeking stability and growth.

By leveraging the strengths demonstrated by BICICI, investors can capitalize on the robust performance and resilience of the banking sector, ensuring a profitable and secure investment.

Want to stay ahead of the curve and discover more high-potential investment opportunities like this? Download the Daba app now and unlock access to the best investment insights and tools.

***1 USD = 680 XOF as of Friday June 21, 2024.

Leave a Reply