La diaspora africaine – surnommée “l’arme secrète” de l’Afrique – représente une opportunité de 100 milliards de dollars pour les startups, les entreprises et les gouvernements sur un continent de plus en plus en besoin de sources de financement externes stables.

Les Africains vivant hors du continent, connus sous le nom de diaspora, sont devenus les plus grands soutiens financiers du continent.

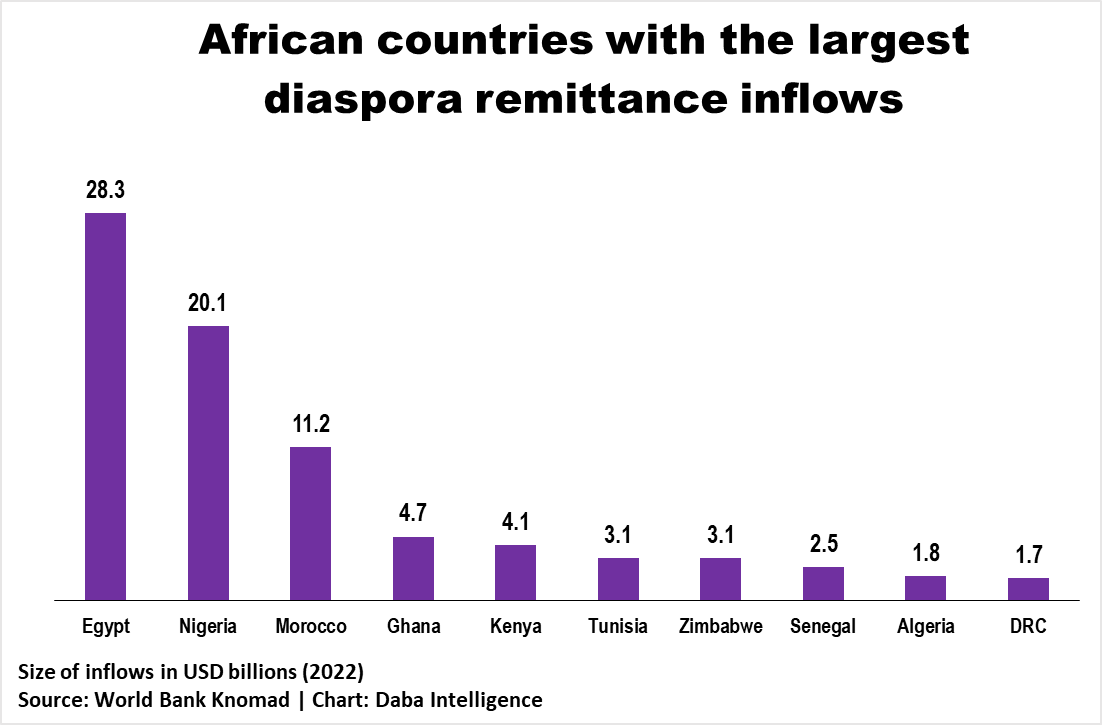

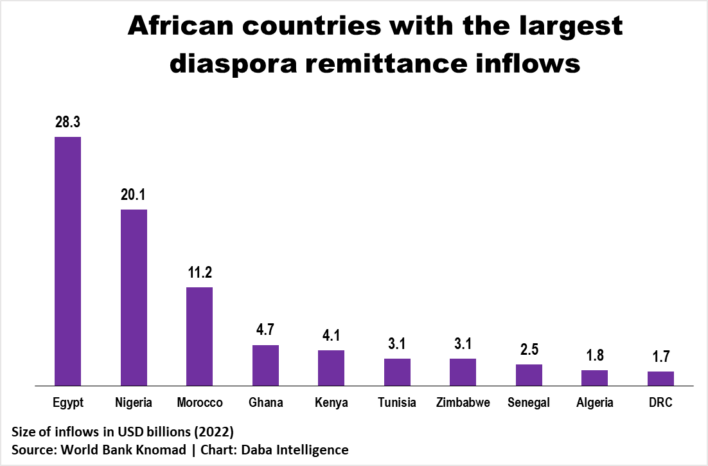

La diaspora, forte de 160 millions de personnes, envoie chaque année environ 100 milliards de dollars chez eux, soutenant les économies comme une source vitale de devises étrangères.

Cela signifie qu’à l’opposé de l’image dominante de l’Afrique comme un cas de charité, plus d’entrées de capitaux proviennent des Africains de l’étranger que de l’aide étrangère.

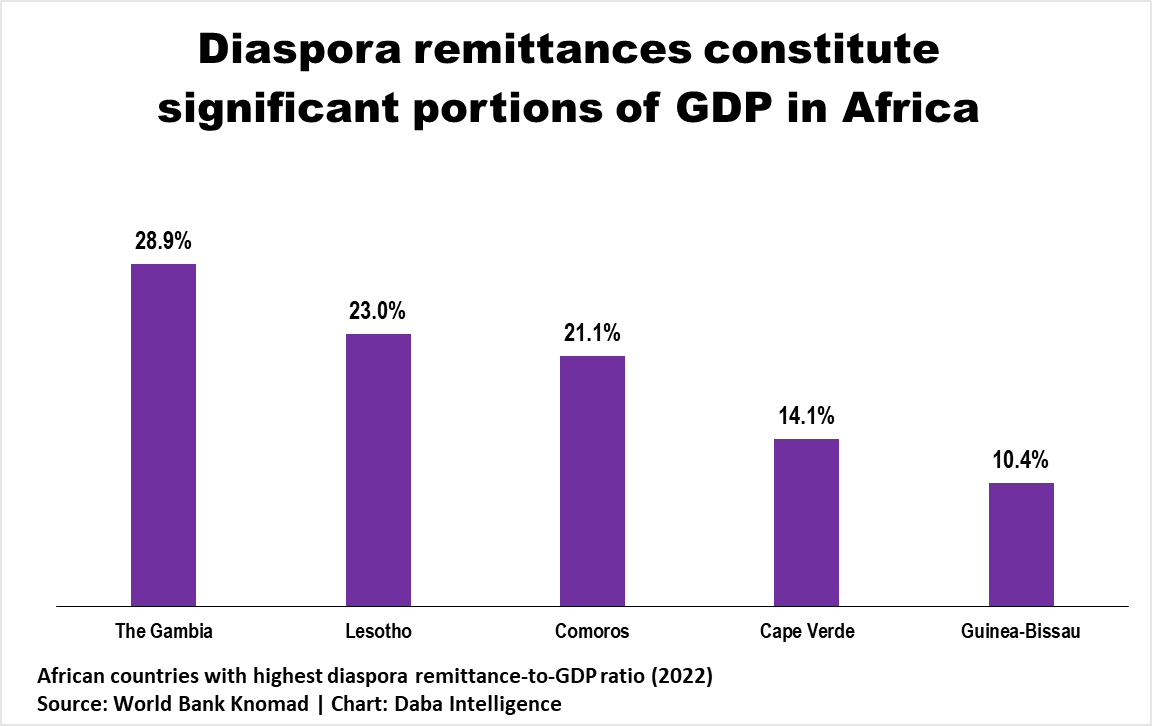

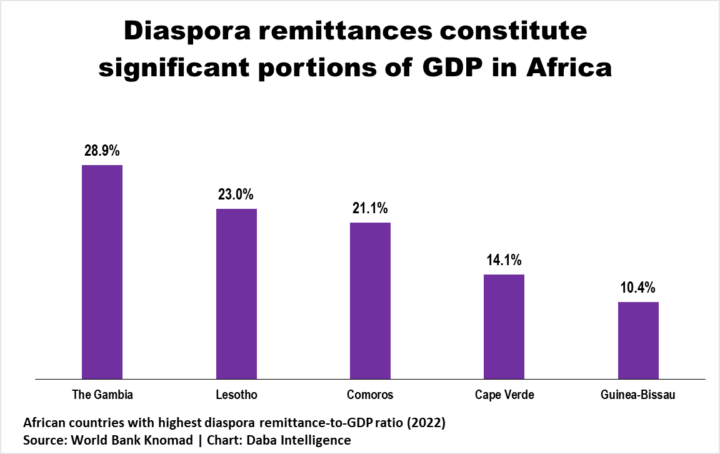

Et cet argent représente 2 à 3 % du PIB du continent (dans des pays comme la Gambie, les envois de fonds représentent près de 30 % du PIB) tout en soutenant quelque 200 millions de personnes.

Il y a maintenant un enthousiasme croissant pour utiliser ces fonds pour soutenir les entreprises, les infrastructures et d’autres projets de développement à long terme.

Cependant, cela dépend de la capacité des gouvernements africains à établir des relations avec leurs diasporas.

Bien que cela soit important pour les experts en politique, la puissance financière de la diaspora en fait également une base de clients attrayante et une source potentielle de financement pour les startups et les entreprises sur le continent.

De nombreux innovateurs axés sur l’Afrique intègrent désormais les Africains riches en liquidités vivant à l’étranger dans leurs stratégies de financement et de marché.

Des services financiers au divertissement en passant par le Web3, les Africains construisent des solutions autour de la communauté diasporique.

Nous en explorons quelques-uns.

Lire aussi : Les dollars de la diaspora en Afrique : Accroître l’impact des entreprises

Services financiers

Les services financiers destinés à la diaspora africaine doivent répondre à des défis courants comme les envois de fonds coûteux, l’accès limité aux services bancaires et la création d’historiques de crédit à l’étranger.

Des startups émergent pour combler ces besoins.

Moneco offre à la diaspora africaine en Europe des transferts d’argent sans frais, des services bancaires mobiles, des cercles d’épargne et d’autres outils financiers familiers et abordables.

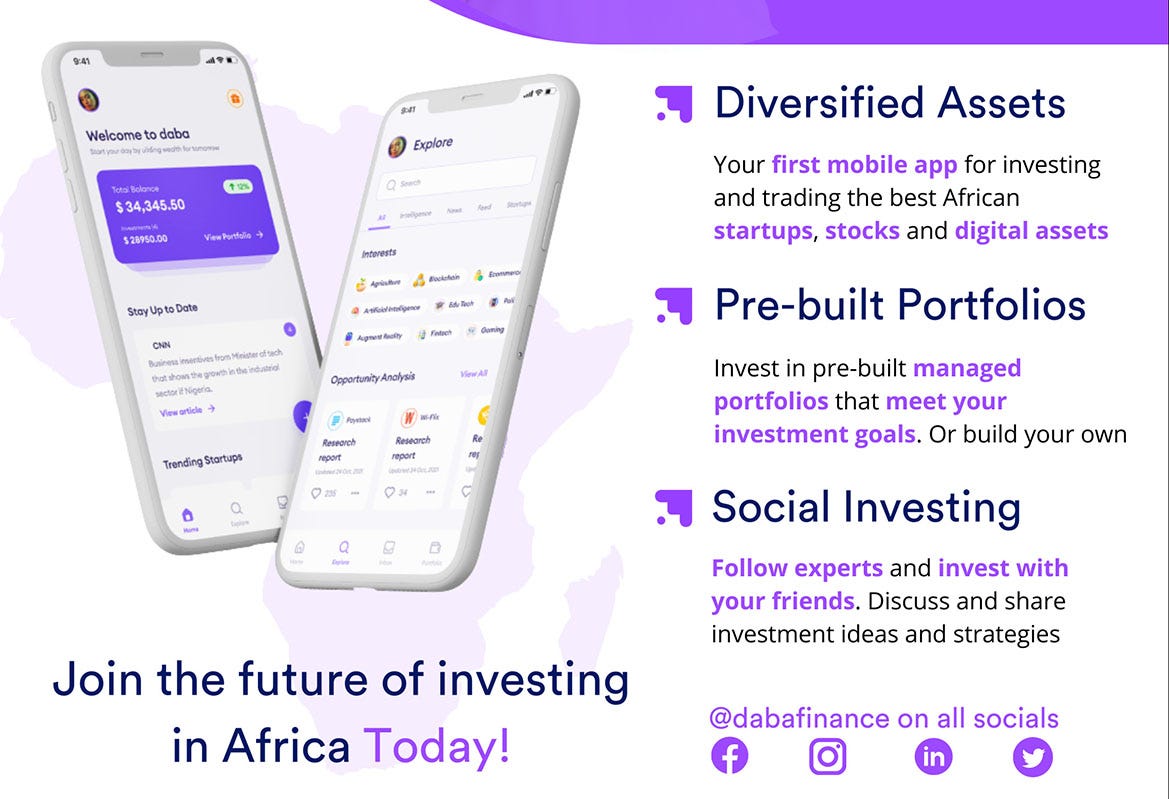

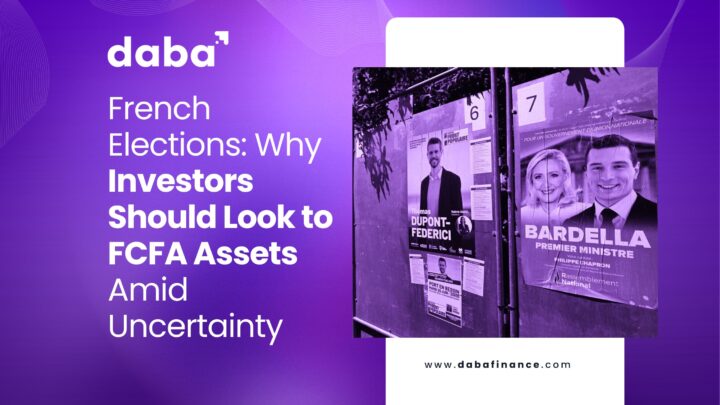

Daba permet aux membres de la diaspora d’investir facilement dans les principales entreprises privées et publiques d’Afrique, offrant un accès facile aux marchés de capitaux du continent.

Il a déjà facilité des investissements dans des entreprises comme Spleet, la plateforme de mobilité BuuPass, Lengo AI, et le géant des télécommunications Orange.

Les deux exploitent la diaspora comme point de lancement stratégique vers le continent.

D’autres startups répondent à des points de douleur spécifiques des migrants.

Betascore, par exemple, aide les Africains à construire des historiques de crédit avant de partir à l’étranger afin qu’ils puissent accéder à des prêts et des hypothèques.

Bee aide également les migrants à établir des identités financières et à accéder aux services bancaires grâce à un système de registre numérique innovant.

Alors que les migrants du monde entier envoient des milliards chez eux chaque année, les services financiers adaptés peuvent tirer parti de ce vaste flux de remises.

En résolvant les problèmes liés aux transferts, aux services bancaires, aux investissements et au crédit, les startups peuvent s’intégrer tôt dans les habitudes financières de la diaspora et évoluer avec leurs utilisateurs au fur et à mesure qu’ils deviennent plus riches à l’étranger.

La montée en puissance de la diaspora représente une opportunité.

Envois de fonds

Alors que de nombreux services visent à faciliter les envois de fonds de la diaspora vers l’Afrique, Kaoshi adopte une approche novatrice d’infrastructure financière ouverte.

À l’instar de Plaid qui agrège les données bancaires pour la finance intégrée, Kaoshi agrège les services financiers transfrontaliers.

Cela permet aux entreprises africaines d’intégrer les paiements internationaux de fournisseurs comme Remitly, Wise et WorldRemit dans leurs applications.

Par exemple, les compagnies aériennes pourraient permettre aux clients de la diaspora d’acheter des billets pour leurs proches en utilisant ces services plutôt que des cartes.

L’infrastructure de Kaoshi réduit les frais souvent exorbitants des envois de fonds qui siphonnent les fonds. Bien que les données soient datées, environ 10 % de l’argent envoyé en Afrique pourrait être perdu en frais de transaction.

L’opportunité des envois de fonds est l’une des plus recherchées à travers le continent.

Les acteurs majeurs comme Chipper Cash, Sendwave et NALA mènent la charge pour rendre les transferts moins chers et plus rapides, mais rivalisent avec des centaines de concurrents pour le marché.

Innombrables fintechs et entreprises traditionnelles veulent une part des 100 milliards de dollars d’opportunités annuelles.

Capturer les fonds de la diaspora pourrait améliorer les moyens de subsistance individuels et les économies nationales.

Santé

Alors que les envois de fonds fournissent principalement des besoins de base comme la nourriture et le logement, les dépenses de santé représentent également une part importante.

Susu exploite cela en offrant aux abonnés de la diaspora des packages de soins couvrant leurs familles avec des avantages de santé.

Une healthtech africaine francophone leader, Susu dessert actuellement la Côte d’Ivoire, le Cameroun, le Sénégal et le Bénin, mais s’étend bientôt en Afrique de l’Ouest anglophone.

Au-delà des envois de fonds, les startups permettent des soins spécialisés pour les familles de la diaspora restées au pays.

Fleri aide à créer des plans de soins de santé sur mesure, orientant les dépenses vers les besoins médicaux spécifiques de la famille plutôt que des transferts de fonds généraux.

Awabah adopte une approche similaire pour les pensions – aidant la diaspora à établir des économies de retraite pour leurs proches sur le continent.

Lire aussi : Libérer le potentiel de l’Afrique : Un guide pour les investisseurs de la diaspora

Alors que l’infrastructure de santé de l’Afrique évolue, la diaspora et les startups ont des rôles pivots à jouer.

Les envois de fonds pourraient passer d’un soutien généralisé à des services ciblés.

Et en associant la puissance financière de la diaspora à des solutions évolutives, les startups peuvent améliorer les soins pour ceux qui restent grâce à une innovation agile.

Renforcement communautaire

Les membres de la diaspora africaine partagent souvent certaines expériences formatrices.

Migrer à l’étranger ou grandir déconnecté de sa culture d’origine peut alimenter des sentiments d’isolement et d’aliénation.

Des communautés numériques comme Afropolitan visent à unir la diaspora mondiale africaine en créant un hub en ligne pour la connexion, la communication et la collaboration.

Décrite diversément comme une “plateforme de communauté en tant que service”, un “pays internet” et un “état de réseau”, Afropolitan aspire à devenir une nation virtuelle pour les personnes d’origine africaine dispersées à travers le monde.

Plus simplement, elle cherche à agréger une communauté diasporique fragmentée et à favoriser un sentiment partagé d’identité, de but et d’appartenance.

Si Afropolitan intègre avec succès les membres de la diaspora au niveau mondial – devenant un point de rassemblement vital pour la communauté africaine mondiale – elle pourrait offrir une valeur immense.

Soutenue par des investisseurs angéliques de haut niveau comme Shola Akinlade de Paystack, Iyinoluwa Aboyeji de Future Africa, Olugbenga “GB” Agboola de Flutterwave, et des financeurs institutionnels comme Atlantica Ventures, Ingressive Capital et RaliCap, la plateforme a les ressources pour essayer de réaliser son ambition de construire une “nation numérique”.

D’autres initiatives adoptent une approche plus professionnelle, comme Movemeback qui lie les émigrés africains avec des perspectives de carrière et d’investissement sur le continent.

Alors que les réseaux en ligne de la diaspora continuent de proliférer, il sera intéressant de suivre le développement de visions audacieuses pour autonomiser les Africains à l’étranger.

Les avantages collectifs potentiels pour les membres de la diaspora restent à voir.

Divertissement

Rester culturellement connecté à la maison est une priorité absolue pour les Africains à l’étranger.

Les plateformes de streaming comme IrokoTV répondent à ce besoin en diffusant des hits de Nollywood et d’autres contenus localisés aux audiences de la diaspora.

Fondée en 2011, IrokoTV exploite la demande des Nigérians déplacés et des communautés africaines plus larges pour se connecter avec les points de repère artistiques et culturels du pays.

Alors que Netflix et Showmax enrichissent leurs catalogues africains, une nouvelle génération de services de streaming se concentre exclusivement sur des cultures et des marchés spécifiques à travers le continent.

Un exemple notable est Wi-flix, l’un des services de streaming en expansion rapide en Afrique, qui a récemment fait ses débuts en Zambie grâce à une collaboration avec MTN.

La Zambie est le quatrième pays sur le continent où Wi-flix est disponible, après le Kenya, le Ghana et le Nigeria.

L’expansion s’aligne sur la vision de l’entreprise de devenir le principal fournisseur de contenu à travers l’Afrique.

Porté par une démographie jeune en pleine croissance et une accessibilité croissante à Internet, les projections de la firme de renseignement commerciale

londonienne Digital TV Research prévoient que les abonnements à la vidéo à la demande en Afrique passeront à 15 millions d’ici 2026, un bond significatif par rapport aux 5 millions enregistrés en 2021.

De plus, les revenus de l’industrie devraient tripler, passant de 623 millions de dollars en 2021 à 2 milliards de dollars en 2027.

Cependant, les ambitions de Wi-flix ne se limitent pas au continent africain. L’entreprise vise également à se positionner comme la principale plateforme de streaming connectant la diaspora africaine à ses racines.

La formule offre une proposition commerciale convaincante – les spectateurs de la diaspora à l’étranger ont généralement plus de revenus disponibles que leurs homologues à domicile, mais désirent l’authenticité du divertissement local.

Alors que les industries créatives de l’Afrique sont en plein essor, les innovateurs du streaming continueront de cibler cette niche mondiale d’Africains aisés cherchant de plus en plus à se connecter à leur pays d’origine.

Positionnement vers la diaspora africaine

La diaspora africaine, ou les personnes d’origine africaine vivant hors du continent, est si grande que si elle était un pays, elle serait deuxième après le Nigeria en termes de population.

L’Union africaine (UA) l’appelle même la “sixième région” de l’Afrique, aux côtés de régions comme l’Afrique du Sud, du Nord, du Centre, de l’Est et de l’Ouest.

Ces membres de la diaspora travaillent, créent des entreprises et étudient aux États-Unis, au Canada et au Royaume-Uni. Ils sont souvent considérés comme “l’arme secrète” de l’Afrique en raison de leurs compétences et de leur influence.

Au Nigeria, il y a un mot, “japa”, qui signifie fuir. Les gens l’utilisent pour parler de quitter le Nigeria pour trouver des opportunités ailleurs, notamment à l’étranger.

Les entreprises prêtent de plus en plus attention à la diaspora africaine car elle a un potentiel énorme pour avoir un impact économique majeur.

Et pour exploiter pleinement leur potentiel à faire avancer le continent, les dirigeants politiques africains doivent réfléchir à la manière de collaborer avec cette communauté mondiale d’Africains.