Le rendement d’une obligation est essentiellement le retour qu’un investisseur reçoit sur son investissement, généralement exprimé en pourcentage et calculé de plusieurs manières.

Les rendements des obligations sont un concept crucial dans le monde de la finance et de l’investissement. Ils représentent le retour qu’un investisseur peut s’attendre à gagner en détenant une obligation.

Comprendre les rendements des obligations est essentiel tant pour les investisseurs individuels qu’institutionnels, car ils jouent un rôle significatif dans les décisions d’investissement et l’analyse économique.

Explorons plus en détail le concept des rendements obligataires.

Qu’est-ce qu’une Obligation ?

Avant d’aborder les rendements, il est important de comprendre ce qu’est une obligation. Une obligation est essentiellement un prêt consenti par un investisseur à un emprunteur, typiquement un gouvernement ou une entreprise.

Lorsque vous achetez une obligation, vous prêtez de l’argent à l’émetteur pour une période spécifique, connue sous le nom de terme jusqu’à l’échéance. En retour, l’émetteur promet de vous verser des paiements d’intérêts réguliers et de vous rembourser le montant principal à l’échéance de l’obligation.

À Lire Aussi : Pourquoi Investir dans les Obligations et Quels En Sont les Avantages ?

Par exemple, le gouvernement nigérian pourrait émettre une obligation à 10 ans d’une valeur nominale de 100 000 nairas. Un investisseur qui achète cette obligation prête effectivement 100 000 nairas au gouvernement nigérian pour une durée de 10 ans.

Les Bases du Rendement Obligataire

Le rendement d’une obligation est essentiellement le retour qu’un investisseur reçoit sur son investissement. Il est généralement exprimé en pourcentage et peut être calculé de plusieurs façons. La forme la plus simple de rendement est le rendement du coupon, qui est le paiement d’intérêts annuel divisé par la valeur nominale de l’obligation.

Par exemple, si notre obligation du gouvernement nigérian verse 5 000 nairas d’intérêts annuels, son rendement du coupon serait de 5 % (5 000 / 100 000). Cependant, ce calcul de base ne raconte pas toute l’histoire, car il ne tient pas compte des variations du prix de marché de l’obligation ni de la valeur temporelle de l’argent.

Rendement Actuel

Le rendement actuel offre une image plus précise du retour d’une obligation basé sur son prix de marché actuel. Il est calculé en divisant le paiement d’intérêts annuel par le prix de marché actuel de l’obligation.

Supposons que notre obligation du gouvernement nigérian se négocie maintenant à 95 000 nairas sur le marché secondaire. Le rendement actuel serait d’environ 5,26 % (5 000 / 95 000). Ce rendement plus élevé reflète le fait que l’obligation se négocie à un prix inférieur à sa valeur nominale.

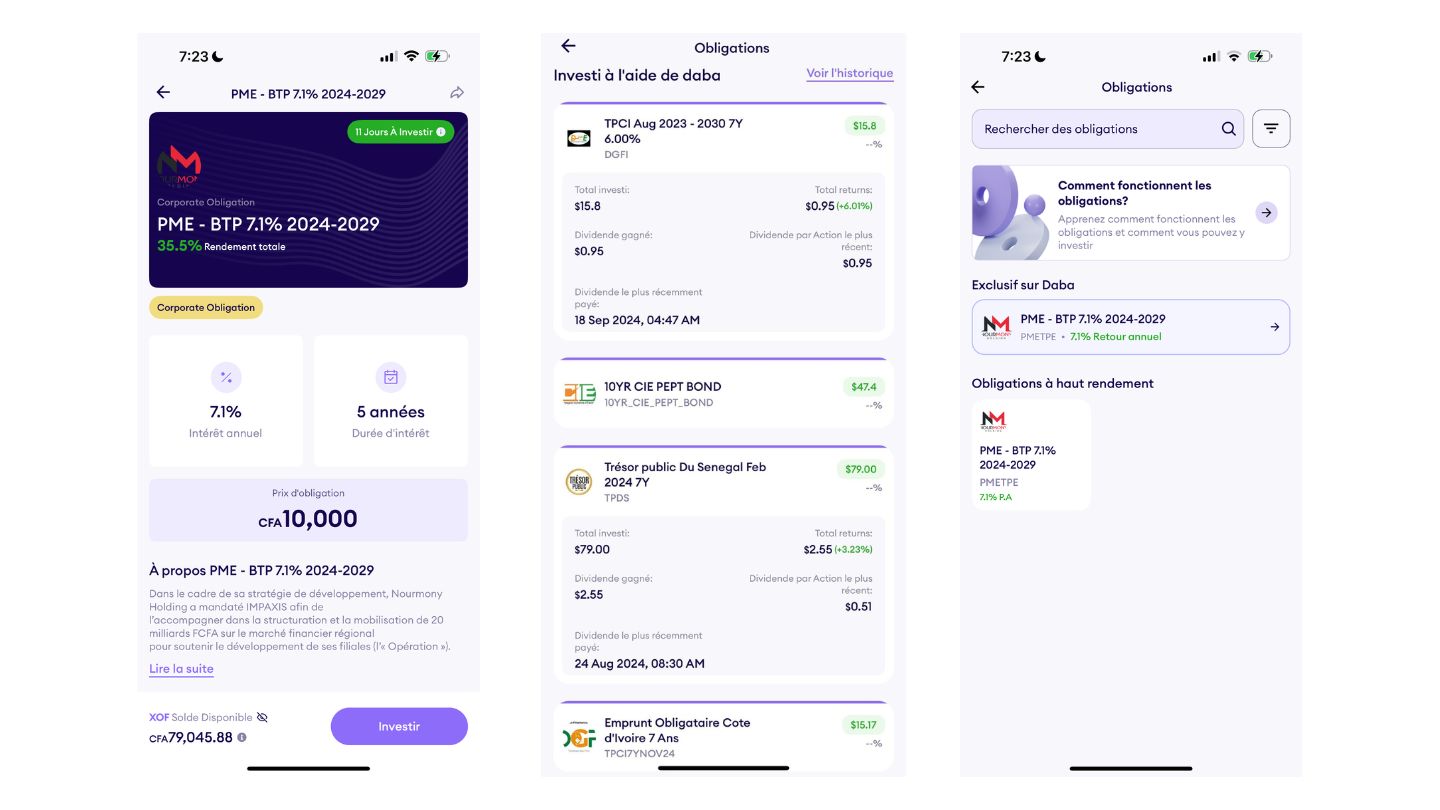

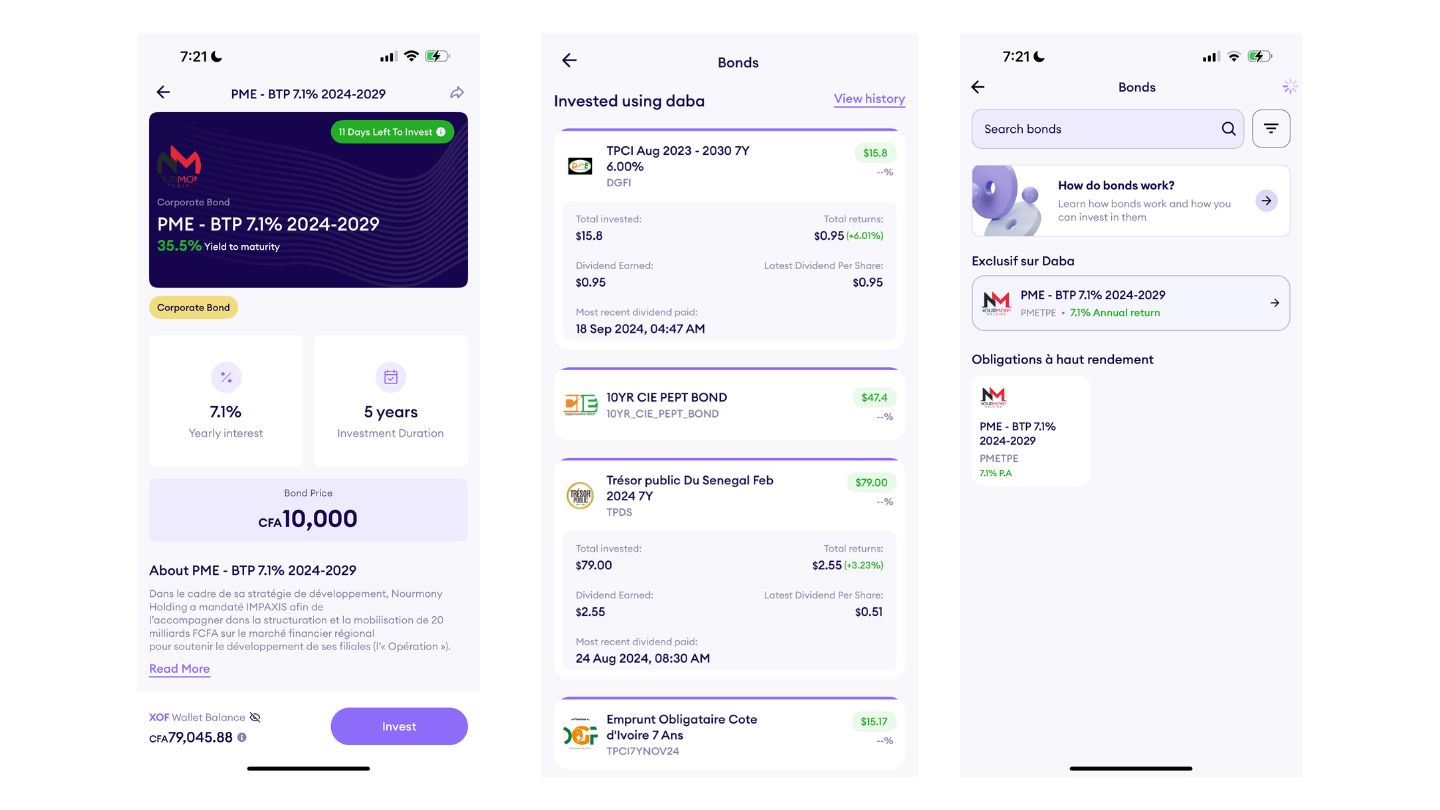

Rendement à l’Échéance

Le rendement à l’échéance (YTM) est considéré comme la mesure la plus complète du rendement d’une obligation. Il prend en compte le prix de marché actuel, la valeur nominale, le taux de coupon et le temps restant jusqu’à l’échéance. Le YTM représente le rendement total qu’un investisseur recevrait s’il détenait l’obligation jusqu’à son échéance, en supposant que tous les paiements d’intérêts sont réinvestis au même taux.

Le calcul du YTM est plus complexe et nécessite souvent l’utilisation de logiciels financiers ou de calculatrices. Pour notre exemple d’obligation nigériane, si elle se négocie à 95 000 nairas avec 5 ans restants jusqu’à l’échéance, son YTM pourrait être d’environ 6,2 %, en supposant que tous les paiements sont réinvestis à ce taux.

La Relation Entre les Prix des Obligations et les Rendements

L’un des concepts les plus importants à comprendre concernant les rendements obligataires est leur relation inverse avec les prix des obligations. Lorsque les prix des obligations augmentent, les rendements diminuent, et vice versa. Cette relation est cruciale pour comprendre le comportement des obligations sur le marché.

Par exemple, si les taux d’intérêt au Kenya augmentent, les obligations nouvellement émises offriront des taux de coupon plus élevés pour attirer les investisseurs. Cela rend les obligations existantes avec des taux de coupon plus bas moins attractives, entraînant une baisse de leurs prix et une hausse de leurs rendements.

Facteurs Affectant les Rendements des Obligations

Plusieurs facteurs peuvent influencer les rendements des obligations :

Taux d’Intérêt : Comme mentionné, les changements dans les taux d’intérêt en vigueur affectent directement les rendements des obligations. Lorsque la Banque Centrale du Nigeria augmente les taux d’intérêt, par exemple, les rendements des obligations augmentent généralement.

Qualité de Crédit : Les obligations émises par des entités ayant des notations de crédit plus faibles (comme certaines obligations d’entreprise) offrent généralement des rendements plus élevés pour compenser le risque accru de défaut. Par exemple, une obligation émise par une entreprise sud-africaine stable de premier plan pourrait avoir un rendement inférieur à celui émis par une entreprise ghanéenne plus petite et moins établie.

Maturité : En général, les obligations à plus long terme offrent des rendements plus élevés que les obligations à court terme pour compenser le risque accru associé au prêt d’argent sur une période plus longue.

Conditions Économiques : Des facteurs économiques tels que l’inflation, la croissance du PIB et la stabilité politique peuvent tous influencer les rendements des obligations. Par exemple, lors de périodes de forte inflation au Zimbabwe, les rendements des obligations pourraient augmenter pour compenser les investisseurs pour la diminution du pouvoir d’achat de l’argent.

Offre et Demande : L’offre globale d’obligations sur le marché et la demande des investisseurs peuvent influencer les rendements. S’il y a une forte demande pour les obligations gouvernementales marocaines, par exemple, leurs rendements pourraient diminuer.

À Lire Aussi : Investir en Afrique : Optimisez Votre Portefeuille avec les Rendements des Dividendes

La Courbe de Rendement

La courbe de rendement est une représentation graphique des rendements des obligations ayant différentes maturités. Dans un environnement économique normal, la courbe de rendement s’incline vers le haut, les obligations à plus long terme offrant des rendements plus élevés que les obligations à court terme. Cela est souvent considéré comme un signe de bonne santé économique.

Cependant, parfois, la courbe de rendement peut devenir “inversée”, où les rendements à court terme sont plus élevés que ceux à long terme. Cela est souvent perçu comme un indicateur potentiel d’une récession imminente. Par exemple, si les bons du Trésor nigérians à court terme commençaient à offrir des rendements plus élevés que les obligations gouvernementales nigérianes à 10 ans, cela pourrait signaler une incertitude économique.

Pourquoi les Rendements des Obligations Comptent

Les rendements des obligations sont importants pour plusieurs raisons :

Décisions d’Investissement : Les rendements aident les investisseurs à comparer différentes obligations et à prendre des décisions d’investissement éclairées. Un investisseur en Égypte pourrait comparer les rendements des obligations gouvernementales égyptiennes avec celles des obligations d’entreprise pour décider où allouer ses fonds.

Indicateur Économique : Les rendements des obligations, en particulier ceux des obligations gouvernementales, sont souvent utilisés comme indicateurs de la santé économique et du sentiment des investisseurs. Des rendements faibles sur les obligations gouvernementales sud-africaines, par exemple, pourraient indiquer la confiance des investisseurs dans la stabilité économique du pays.

Politique Monétaire : Les banques centrales prêtent une grande attention aux rendements des obligations lors de la prise de décisions en matière de politique monétaire. La Banque du Ghana, par exemple, pourrait considérer les rendements des obligations gouvernementales ghanéennes lorsqu’elle décide d’ajuster les taux d’intérêt.

Financement des Entreprises : Les rendements des obligations influencent le coût d’emprunt des entreprises. Si les rendements sont bas, il est moins coûteux pour les entreprises d’émettre des obligations et de lever des capitaux, ce qui peut stimuler la croissance économique.

Taux Hypothécaires : Dans de nombreux pays, les taux hypothécaires sont souvent liés aux rendements des obligations gouvernementales. Des changements dans les rendements des obligations gouvernementales kenyanes, par exemple, pourraient influencer les taux d’intérêt offerts sur les hypothèques au Kenya.

Utilisation des Rendements des Obligations dans les Stratégies d’Investissement

Les investisseurs peuvent utiliser les rendements des obligations de diverses manières :

Génération de Revenus : Les obligations à rendements plus élevés peuvent fournir un flux de revenus régulier. Des retraités en Namibie, par exemple, pourraient investir dans des obligations d’entreprise à haut rendement pour compléter leurs revenus de pension.

Diversification de Portefeuille : En incluant des obligations avec différents rendements dans un portefeuille, les investisseurs peuvent équilibrer le risque et le rendement. Un investisseur sud-africain pourrait combiner des obligations d’entreprise à haut rendement avec des obligations gouvernementales à rendement plus faible pour diversifier son portefeuille.

Stratégies Basées sur la Courbe de Rendement : Des investisseurs sophistiqués pourraient utiliser des stratégies basées sur la forme de la courbe de rendement. Par exemple, si un investisseur s’attend à ce que la courbe de rendement au Nigeria s’accentue, il pourrait vendre des obligations à court terme et acheter des obligations à long terme.

Comprendre Correctement les Rendements des Obligations

Les rendements des obligations sont un concept fondamental en finance, fournissant des informations cruciales sur le retour des investissements obligataires et les conditions économiques générales.

Que vous soyez un investisseur individuel au Kenya envisageant d’ajouter des obligations à votre portefeuille, ou un analyste financier en Afrique du Sud évaluant les tendances économiques, comprendre les rendements des obligations est essentiel.

Rappelez-vous que, bien que des rendements plus élevés puissent sembler attractifs, ils s’accompagnent souvent de risques plus élevés. Il est important de considérer vos objectifs d’investissement, votre tolérance au risque et le contexte économique global lors de l’interprétation et de l’action sur les informations relatives aux rendements obligataires.

Comme pour tout investissement, il est conseillé de consulter un professionnel financier avant de prendre des décisions d’investissement importantes basées sur les rendements des obligations ou tout autre indicateur financier.