À l’approche du second tour crucial des élections législatives anticipées en France le 7 juillet 2024, le paysage politique est plus incertain que jamais.

Avec le parti d’extrême droite du Rassemblement National (RN) gagnant du terrain et la possibilité d’un changement significatif dans les politiques économiques, les investisseurs français et les détenteurs d’euros peuvent chercher à diversifier leurs portefeuilles.

Une option souvent négligée qui mérite d’être considérée est celle des obligations et actions africaines libellées en FCFA.

Voici pourquoi ces investissements pourraient être attrayants dans le climat actuel.

Le Bouleversement Électoral en France

Avant de plonger dans les investissements africains, récapitulons la situation en France :

- Le président Emmanuel Macron a convoqué des élections anticipées après que son alliance centriste ait mal performé aux élections européennes.

- Le Rassemblement National, dirigé par Jordan Bardella et Marine Le Pen, a pris la tête au premier tour avec 34% des voix.

- Un scénario de “cohabitation” pourrait émerger, avec Macron comme président mais un gouvernement dirigé par le RN.

Avec le Rassemblement National gagnant du terrain, il y a une réelle possibilité de changements politiques significatifs qui pourraient impacter les marchés français et européens. Cette volatilité politique justifie fortement une diversification géographique. Les marchés africains, en particulier ceux utilisant le FCFA (Franc CFA), offrent une alternative intéressante tout en restant connectés à la zone euro.

Implications d’un Gouvernement Dirigé par l’Extrême Droite sur les Marchés

La performance électorale forte du Rassemblement National a introduit une nouvelle ère de conservatisme fiscal et d’incertitude sur les marchés. Les actions françaises et l’euro ont augmenté lundi.

L’indice CAC 40 a progressé de 1,5% après le premier tour, les actions bancaires montrant des récupérations significatives : Société Générale +4,3%, Crédit Agricole +3,8%, et BNP Paribas +3,4%.

Jean-Philippe Tanguy, responsable financier du RN, s’est engagé à réduire le déficit à 3% du PIB d’ici 2027 et à respecter les règles fiscales de l’UE. Cet engagement a quelque peu apaisé les craintes du marché, bien que des préoccupations subsistent quant à la faisabilité du programme économique du RN, notamment leur promesse de réduire la TVA sur l’énergie de 20% à 5,5%.

Une politique fiscale stricte pourrait avoir un impact significatif sur les marchés financiers. Les rendements obligataires pourraient initialement augmenter alors que les investisseurs exigent des rendements plus élevés pour un risque perçu accru. Cependant, la mise en œuvre réussie de la discipline fiscale pourrait stabiliser ou réduire les rendements à long terme, potentiellement en réduisant l’écart entre les obligations françaises et allemandes.

Sur le marché boursier, les secteurs dépendants des dépenses publiques pourraient rencontrer des difficultés, tandis que ceux bénéficiant de la position pro-business du RN pourraient surperformer. Le secteur bancaire pourrait continuer à bénéficier si la discipline fiscale conduit à un environnement économique plus stable.

L’euro a atteint son niveau le plus fort contre le dollar en plus de deux semaines, indiquant une confiance internationale prudente. Cependant, une volatilité du marché est attendue à mesure que les investisseurs s’adaptent au nouveau paysage politique.

Les semaines à venir seront cruciales alors que les marchés surveillent la formation du nouveau gouvernement et les premières annonces politiques. La capacité du RN à équilibrer les promesses populistes avec la responsabilité fiscale sera la clé pour maintenir la confiance des investisseurs et la stabilité économique dans cette nouvelle ère de la politique française.

La Connexion FCFA : Une Monnaie Familière mais Distincte

Le FCFA, utilisé dans 14 pays africains, maintient un taux de change fixe avec l’euro. Cette connexion offre un niveau de familiarité et de stabilité pour les investisseurs basés en euros tout en offrant une exposition à des économies africaines à forte croissance.

Les principaux avantages du FCFA pour les investisseurs français incluent :

Stabilité de la monnaie : Le taux de change fixe minimise le risque de change. L’ancrage est garanti par le Trésor français, offrant une couche supplémentaire de sécurité.

Familiarité : Les liens historiques entre la France et les pays du FCFA rendent ces marchés plus accessibles.

Diversification : Les actifs en FCFA offrent une exposition à des moteurs économiques différents de ceux des marchés européens.

Les pays de la zone FCFA ont généralement maintenu des taux d’inflation plus bas comparés aux autres nations africaines.

Le taux d’inflation moyen dans les pays du FCFA était de 3,7% en 2023, contre 16,2% pour l’Afrique subsaharienne dans son ensemble.

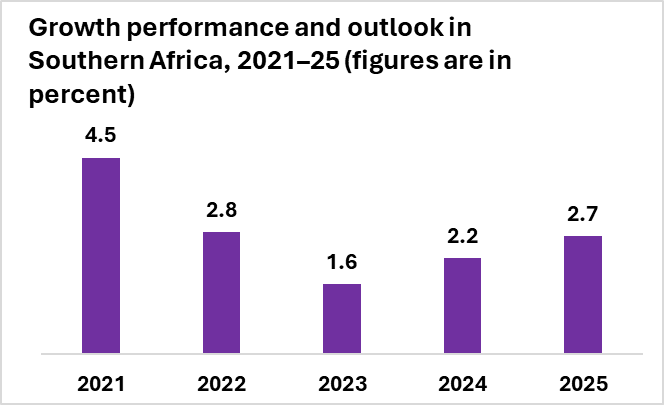

Croissance Économique dans les Pays de la Zone FCFA

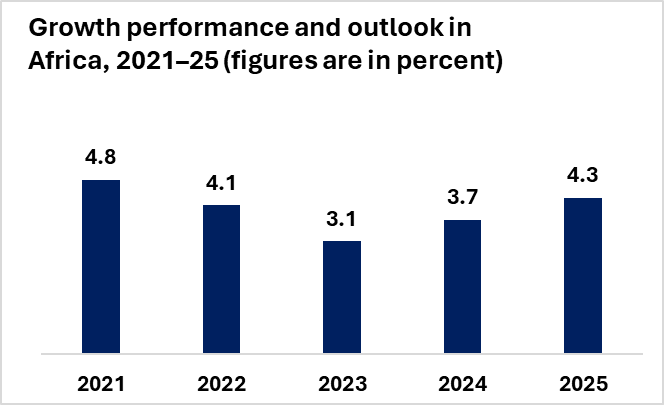

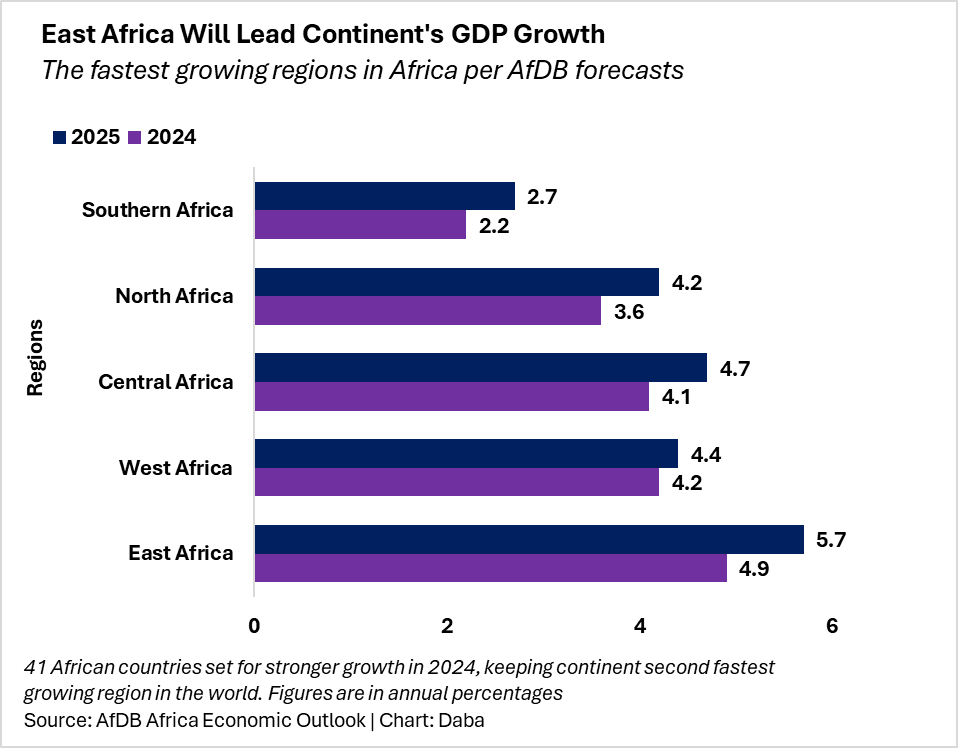

De nombreux pays de la zone FCFA connaissent une croissance économique rapide.

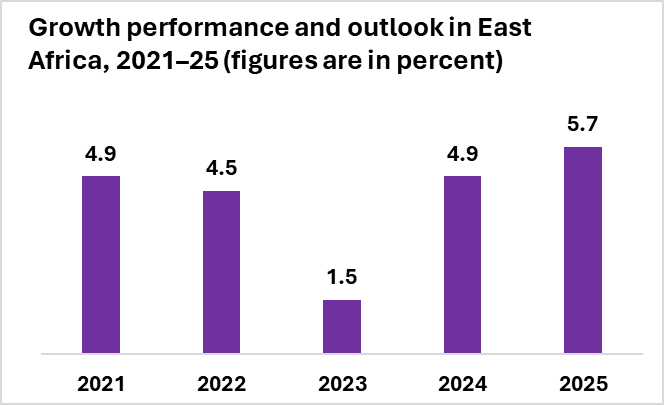

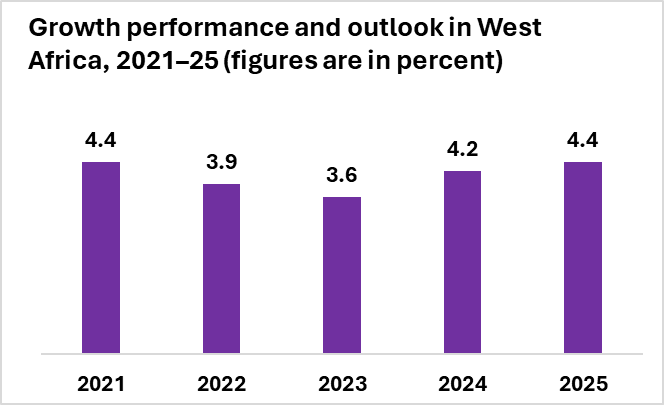

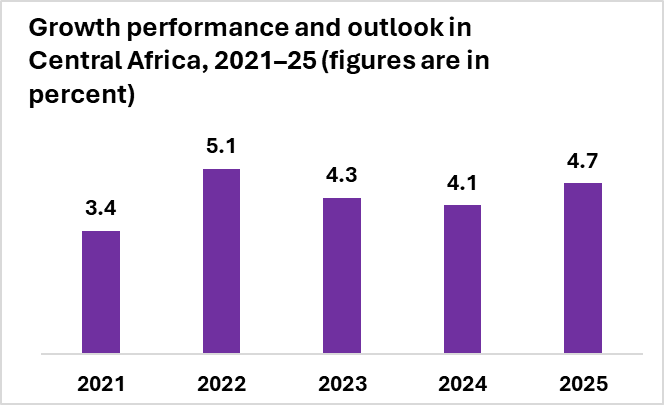

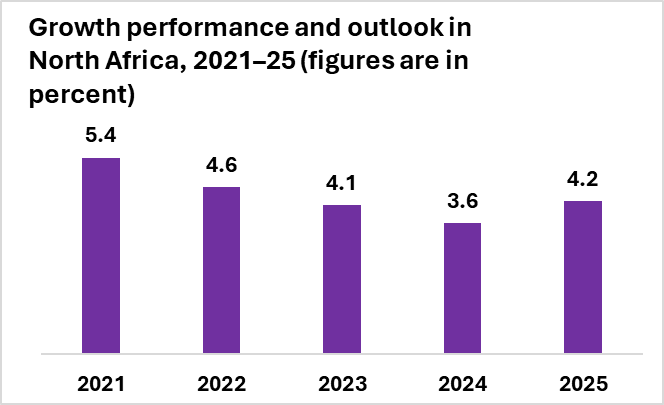

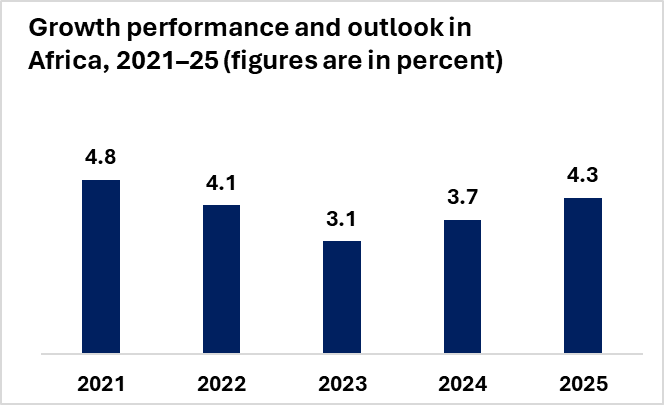

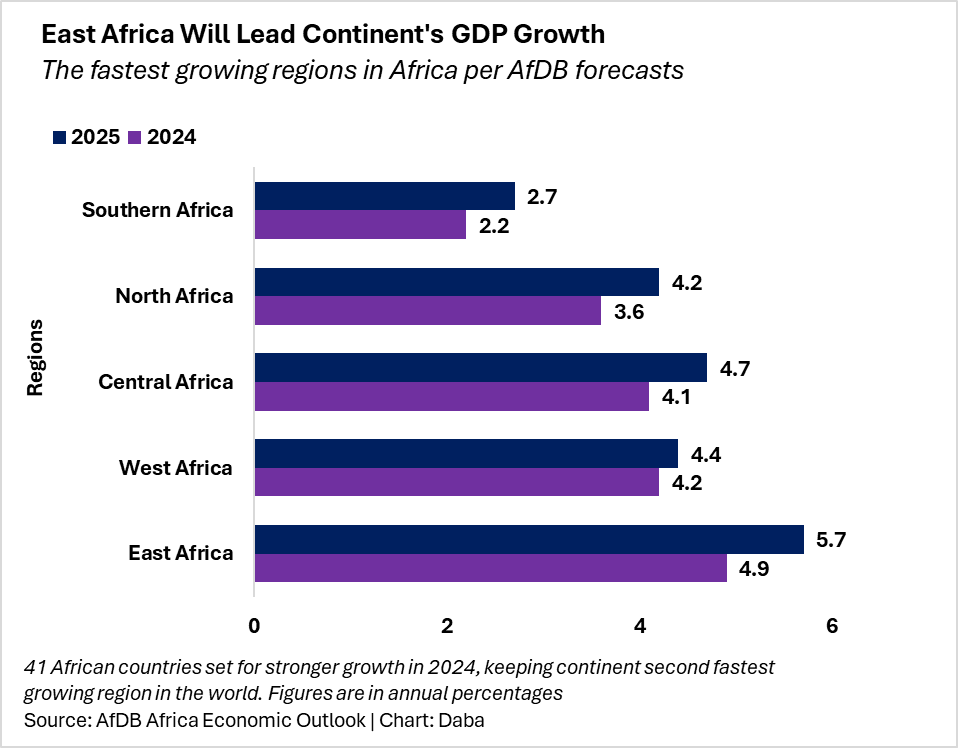

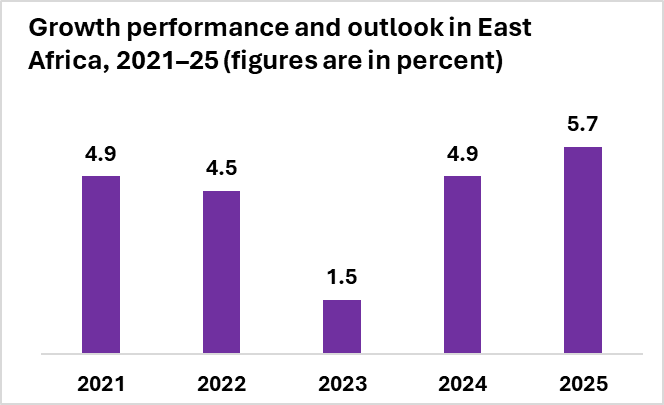

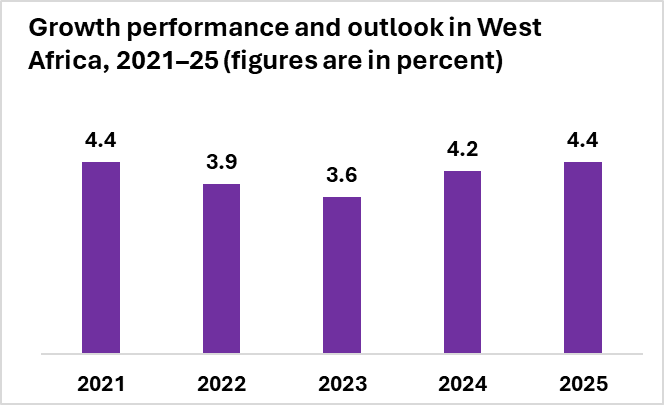

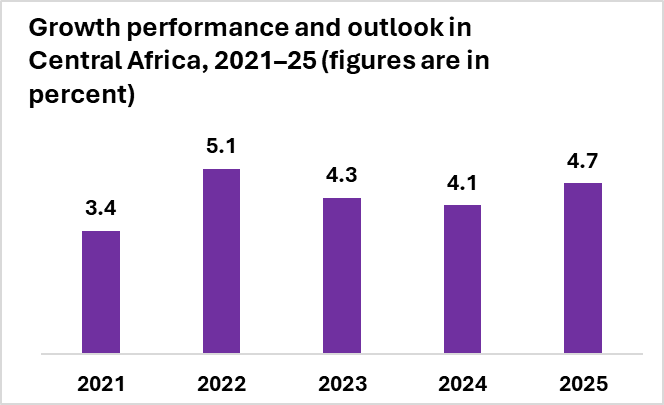

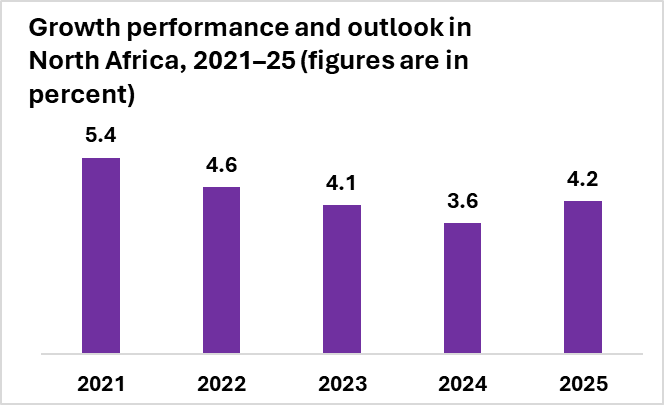

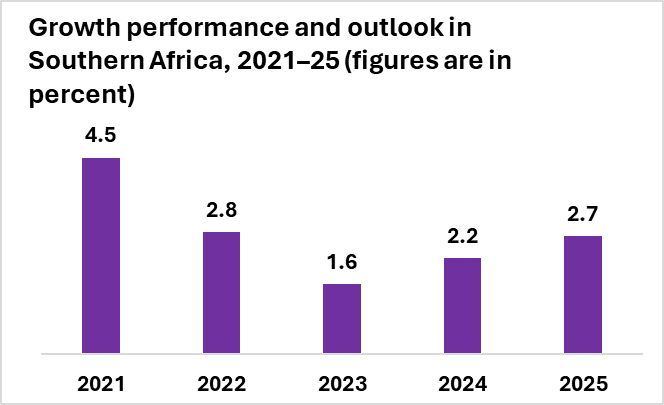

Le FMI projette une croissance de 3,8% en 2024 pour l’Afrique subsaharienne, surpassant les estimations de croissance mondiale.

Des pays spécifiques comme la Côte d’Ivoire et le Sénégal ont des taux de croissance projetés encore plus élevés à 6,5% et 8,3% respectivement.

Quatre des dix économies africaines à la croissance la plus rapide en 2024 se trouvent en Afrique de l’Ouest francophone (PIB réel).

Cela se compare favorablement à la croissance de 0,7% prévue pour la France en 2024 par l’OCDE.

Des secteurs tels que les télécommunications, les services financiers et les ressources naturelles stimulent la croissance dans la région de l’UEMOA.

Cette expansion économique crée des opportunités sur les marchés des actions et des obligations :

Marchés boursiers : Les marchés consommateurs en croissance et le développement des infrastructures stimulent la croissance des entreprises.

Marchés obligataires : Les obligations gouvernementales et d’entreprise offrent souvent des rendements plus élevés que les émissions européennes comparables.

Lire aussi : La Côte d’Ivoire en Plein Essor : Croissance Économique, Découvertes Pétrolières et Un Marché Boursier en Expansion

Avantages de la Diversification

Investir dans des actifs libellés en FCFA offre plusieurs avantages en matière de diversification :

Diversification géographique : En investissant sur les marchés africains, les investisseurs français et européens peuvent répartir le risque entre différentes régions économiques.

Diversification sectorielle : De nombreuses économies africaines sont riches en ressources et ont des marchés consommateurs en croissance, offrant une exposition à des secteurs peut-être sous-représentés dans les portefeuilles européens.

Opportunités de rendement : Avec des taux d’intérêt européens restant bas, les obligations libellées en FCFA peuvent offrir des rendements attractifs. Par exemple, le rendement des obligations d’État françaises à 10 ans était de 2,8% en juin 2024.

En comparaison :

- Le rendement de l’obligation Côte d’Ivoire 5,75% 2032 : ~8%

- Le rendement de l’obligation Sénégal 6,25% 2033 : ~9%

Potentiel du Marché Boursier Émergent

Bien que toujours considérés comme des marchés frontières, de nombreuses bourses africaines montrent des promesses :

Au cours de la dernière décennie, la BRVM a affiché un rendement moyen de plus de 12% sur son marché des actions et un rendement de plus de 6% sur son marché obligataire. Cela a surpassé le CAC 40 (indice boursier français), qui a rapporté 9,2% sur la même période.

Secteurs à Surveiller dans les Marchés Boursiers en FCFA

Plusieurs secteurs dans les pays du FCFA montrent des promesses pour les investisseurs en actions :

Services financiers : Les classes moyennes en croissance augmentent la demande pour les produits bancaires et d’assurance.

Télécommunications : La pénétration mobile est en hausse, stimulant la croissance des services de données et des paiements mobiles.

Biens de consommation : L’urbanisation et l’augmentation des revenus stimulent les dépenses de consommation.

Infrastructures : Les investissements massifs dans l’énergie, le transport et le développement urbain créent des opportunités.

Défis et Considérations de Risque

Bien que les investissements en FCFA offrent des opportunités, il y a des risques à considérer :

Problèmes de liquidité : Les marchés africains peuvent être moins liquides que les marchés développés, rendant potentiellement plus difficile l’achat ou la vente rapide d’actifs.

Risque politique : Bien que le FCFA offre une stabilité monétaire, certains pays peuvent faire face à des défis politiques qui pourraient affecter les investissements.

Asymétrie de l’information : Obtenir des informations détaillées et fiables sur les entreprises et les marchés africains peut être plus difficile que pour les investissements européens.

Des recherches approfondies et la collaboration avec des partenaires locaux comme Daba peuvent aider à atténuer ces risques.

Comment les Résultats des Élections Françaises Peuvent Affecter les Investissements en FCFA

Les résultats des élections anticipées en France pourraient avoir des implications pour les investissements en FCFA :

Une victoire de l’alliance centriste de Macron pourrait maintenir le statu quo dans les relations France-Afrique.

Une forte performance du Rassemblement National pourrait entraîner des changements dans l’approche de la France envers ses anciennes colonies africaines.

Un succès de la gauche pourrait entraîner une augmentation de l’aide au développement et de la coopération économique avec les pays du FCFA.

Les investisseurs doivent surveiller ces résultats et leurs effets potentiels sur les économies et marchés du FCFA.

Comment Investir dans les Actifs Libellés en FCFA

Pour les investisseurs intéressés par les investissements libellés en FCFA :

Recherchez les fondamentaux des pays de la zone FCFA et les opportunités d’investissement spécifiques.

Envisagez de travailler avec des gestionnaires de fonds et des plateformes d’investissement spécialisées dans les marchés africains.

Explorez les ETFs ou fonds communs de placement axés sur les obligations ou actions africaines via des plateformes comme Daba pour une exposition diversifiée.

Pour les investissements directs, comprenez les exigences réglementaires en France et dans le pays cible du FCFA.

Investir dans les actifs en FCFA nécessite une vision à long terme. Ces marchés peuvent être volatils à court terme, mais les investisseurs patients peuvent bénéficier du potentiel de croissance de la région au fil du temps.

Lire aussi : Perspectives Économiques de l’Afrique 2024 : Résilience et Opportunités pour les Investisseurs

Une Opportunité de Diversification Opportune

Alors que la France traverse une période d’incertitude politique, les obligations et actions africaines libellées en FCFA présentent une opportunité de diversification intrigante pour les détenteurs d’euros et les investisseurs français. La combinaison de la stabilité monétaire, du potentiel de croissance et des avantages de rendement rend ces actifs dignes d’être considérés comme partie d’un portefeuille bien équilibré.

Les élections françaises en cours rappellent l’importance de la diversification géographique. Bien que les changements politiques nationaux puissent créer de la volatilité sur les marchés français et européens, les investissements en FCFA offrent une exposition à un ensemble différent de moteurs économiques et de trajectoires de croissance. Bien que ces investissements comportent leurs propres risques, ils pourraient servir de couverture précieuse contre les incertitudes.

Comme toujours, les investisseurs doivent effectuer des recherches approfondies et considérer leur tolérance au risque avant de se lancer dans de nouveaux marchés. Cependant, pour ceux qui sont prêts à regarder au-delà des investissements européens traditionnels, les actifs libellés en FCFA pourraient offrir à la fois des avantages de diversification et des opportunités de croissance à long terme.

En explorant les obligations et actions africaines libellées en FCFA, les investisseurs peuvent potentiellement protéger leurs portefeuilles contre les turbulences politiques nationales tout en tirant parti du dynamisme des marchés émergents africains. Dans une ère d’interconnexion économique mondiale, regarder au-delà des investissements européens traditionnels pourrait s’avérer être une stratégie prudente pour réussir financièrement à long terme.