Lors de l’évaluation de ces métriques, il est important de prendre en compte les défis et opportunités uniques présents sur les marchés diversifiés du continent.

Alors que l’écosystème des startups africaines continue de prospérer, les investisseurs se tournent de plus en plus vers les entrepreneurs innovants du continent.

Cependant, prendre des décisions d’investissement éclairées nécessite une compréhension approfondie des métriques clés qui peuvent indiquer le potentiel de succès d’une startup.

Dans ce blog, nous explorons quelques métriques importantes à considérer avant d’investir dans les startups africaines en 2024.

1. Marché Total Addressable (TAM)

Définition : Le TAM représente l’opportunité de revenu global pour le produit ou service d’une startup. Dans le contexte africain, il est crucial de considérer non seulement la taille actuelle du marché mais aussi le potentiel de croissance à mesure que l’infrastructure et l’adoption technologique s’améliorent à travers le continent.

Exemple : Disons que vous lancez un service de transfert d’argent mobile au Nigeria.

- Population du Nigeria : ~200 millions

- Pourcentage d’adultes avec des téléphones mobiles : ~80% = 160 millions

- Pourcentage susceptible d’utiliser des services de transfert d’argent mobile : ~40% = 64 millions

- Dépense annuelle moyenne pour les transferts d’argent : 100 $

- TAM = 64 millions * 100 $ = 6,4 milliards $

Cela vous donne une idée de la taille potentielle du marché. Cependant, il est également utile de calculer le marché accessible (SAM) et le marché réalisable (SOM).

2. Revenu Mensuel Récurent (MRR)

Définition : Le revenu prévisible et stable généré chaque mois pour les startups basées sur l’abonnement. Un MRR croissant indique que la startup acquiert et retient des clients avec succès.

Exemple : Imaginez que vous avez un produit SaaS pour les petites entreprises au Kenya.

- 100 clients sur le plan de base (20 $/mois)

- 50 clients sur le plan premium (50 $/mois)

- 10 clients sur le plan entreprise (200 $/mois)

- MRR = (100 * 20 $) + (50 * 50 $) + (10 * 200 $) = 2 000 $ + 2 500 $ + 2 000 $ = 6 500 $

Un bon taux de croissance du MRR pour les startups en phase de démarrage est souvent considéré comme étant de 15-20% mois après mois.

3. Coût d’Acquisition Client (CAC)

Définition : Le CAC mesure le coût total d’acquisition d’un nouveau client, y compris les dépenses marketing et commerciales. Comprendre l’efficacité de l’acquisition de clients est crucial.

Exemple : Disons que vous gérez une application de livraison de nourriture au Caire.

- Dépense marketing totale du mois dernier : 10 000 $

- Salaires de l’équipe commerciale : 5 000 $

- Nombre de nouveaux clients acquis : 500

- CAC = (10 000 $ + 5 000 $) / 500 = 30 $ par client

Un bon CAC dépend de votre modèle d’affaires et de votre LTV. En général, vous souhaitez récupérer votre CAC en 12-18 mois.

4. Valeur à Vie (LTV)

Définition : La LTV estime le revenu total qu’une entreprise peut attendre d’un compte client unique tout au long de leur relation.

Exemple : En continuant avec l’application de livraison de nourriture :

- Valeur moyenne de commande : 15 $

- Commandes moyennes par mois : 4

- Durée de vie moyenne du client : 24 mois

- Marge bénéficiaire : 20%

- LTV = 15 $ * 4 * 24 * 0,20 = 288 $

Le ratio LTV:CAC serait de 288:30 ou 9,6:1, ce qui est excellent.

5. Taux de Churn

Définition : Cette métrique suit le pourcentage de clients qui arrêtent d’utiliser un produit ou un service sur une période donnée. Un taux de churn faible est particulièrement important.

Exemple : Pour une application bancaire mobile au Ghana :

- Clients au début du mois : 10 000

- Clients partis durant le mois : 200

- Taux de churn mensuel = 200 / 10 000 = 2%

Un bon taux de churn varie selon l’industrie et le modèle d’affaires.

6. Marge Brute

Définition : La marge brute, calculée comme (Revenu – Coût des biens vendus) / Revenu, indique la rentabilité du modèle commercial de base d’une startup.

Exemple : Considérons une startup d’énergie solaire au Kenya vendant des panneaux solaires et des services d’installation :

- Revenu des ventes et installations : 100 000 $

- Coût des panneaux solaires et des matériaux d’installation : 60 000 $

- Marge Brute = (100 000 $ – 60 000 $) / 100 000 $ = 40%

Une bonne marge brute varie selon l’industrie.

7. Taux de Consommation

Définition : Le taux de consommation montre la rapidité avec laquelle une startup dépense son capital. Un taux de consommation durable est crucial pour la survie à long terme.

Exemple : Une startup fintech au Nigeria :

- 500 000 $ en banque

- Revenu mensuel : 50 000 $

- Dépenses mensuelles : 100 000 $

- Taux de consommation mensuel = 100 000 $ – 50 000 $ = 50 000 $

Cela signifie que l’entreprise “consomme” 50 000 $ de son capital chaque mois.

8. Runway

Définition : Indique combien de temps une startup peut continuer à fonctionner avant de manquer d’argent.

Exemple : En continuant avec l’exemple précédent :

- Cash en banque : 500 000 $

- Taux de consommation mensuel : 50 000 $

- Runway = 500 000 $ / 50 000 $ = 10 mois

10 mois est généralement considéré comme un runway confortable.

9. Taux de Croissance des Utilisateurs

Définition : Cette métrique mesure la vitesse à laquelle une startup acquiert de nouveaux utilisateurs.

Exemple : Une application edtech en Afrique du Sud :

- 10 000 utilisateurs au début de janvier

- 13 000 utilisateurs à la fin de janvier

- Taux de croissance mensuel = (13 000 – 10 000) / 10 000 = 30%

10. Ratio d’Utilisateurs Actifs

Définition : Le pourcentage d’utilisateurs qui utilisent activement le produit ou service.

Exemple : Une application bancaire mobile au Ghana :

- Utilisateurs enregistrés totaux : 100 000

- Utilisateurs ayant effectué au moins une transaction le mois dernier : 65 000

- Ratio d’Utilisateurs Actifs = 65 000 / 100 000 = 65%

11. Taux d’Adoption Mobile

Définition : Le pourcentage d’utilisateurs qui accèdent au produit ou service via des appareils mobiles.

Exemple : Une plateforme de commerce électronique au Nigeria :

- Utilisateurs actifs mensuels totaux : 100 000

- Utilisateurs accédant via des appareils mobiles : 85 000

- Taux d’Adoption Mobile = 85 000 / 100 000 = 85%

12. Taux de Succès des Paiements

Définition : Le pourcentage de paiements tentés qui sont complétés avec succès.

Exemple : Une application de prêt numérique au Kenya :

- Tentatives de paiement total le mois dernier : 10 000

- Paiements réussis : 9 200

- Taux de Succès des Paiements = 9 200 / 10 000 = 92%

13. Économies Unitaires

Définition : Les revenus et coûts associés à une unité de vente unique.

Exemple : Un fournisseur de systèmes solaires domestiques en Tanzanie :

- Prix d’un système : 200 $

- Coût du matériel : 120 $

- Coût d’installation : 30 $

- Coût d’acquisition client : 20 $

- Coût de service sur 2 ans : 10 $

Économies Unitaires :

- Revenu par unité : 200 $

- Coût total par unité : 120 $ + 30 $ + 20 $ + 10 $ = 180 $

- Profit par unité : 200 $ – 180 $ = 20 $

14. Score de Conformité Réglementaire

Définition : Une mesure de la conformité d’une startup aux réglementations pertinentes.

Exemple : Une startup fintech au Ghana :

- Procédures AML/KYC : 95/100

- Protection des données : 90/100

- Rapport financier : 85/100

- Protection des consommateurs : 80/100

- Score de Conformité Global = (95 + 90 + 85 + 80) / 4 = 87,5/100

15. Métriques d’Impact Social

Définition : Mesures de l’impact positif d’une startup sur la société ou l’environnement.

Exemple : Une plateforme de microfinance en Ouganda :

- Inclusion Financière :

- Nouveaux comptes bancaires ouverts : 50 000

- Pourcentage d’emprunteurs féminins : 60%

- Création d’Emplois :

- Emplois directs créés : 500

- Emplois indirects estimés créés par les prêts : 2 000

- Impact Environnemental :

- Réduction des émissions de CO2 par des projets financés : 1 000 tonnes

Pour toutes ces métriques, il est crucial de :

- Comparer aux normes de l’industrie et aux concurrents

- Suivre les tendances dans le temps

- Fixer des objectifs clairs pour l’amélioration

- Utiliser les données pour éclairer les décisions stratégiques

Comment Évaluer les Métriques des Startups

Souvenez-vous, bien que ces métriques soient importantes, elles doivent être considérées dans le cadre d’une vue holistique de l’entreprise.

Une forte croissance des utilisateurs peut justifier un taux de consommation plus élevé, tant que vous avez la runway pour capitaliser sur cette croissance. De même, un ratio élevé d’utilisateurs actifs peut permettre un coût d’acquisition client plus élevé, car les utilisateurs trouvent clairement de la valeur dans votre produit.

En outre, une startup peut exceller dans un domaine mais avoir besoin d’améliorations dans d’autres. L’important est d’utiliser ces métriques pour identifier les forces et les faiblesses et orienter les décisions stratégiques pour une croissance durable.

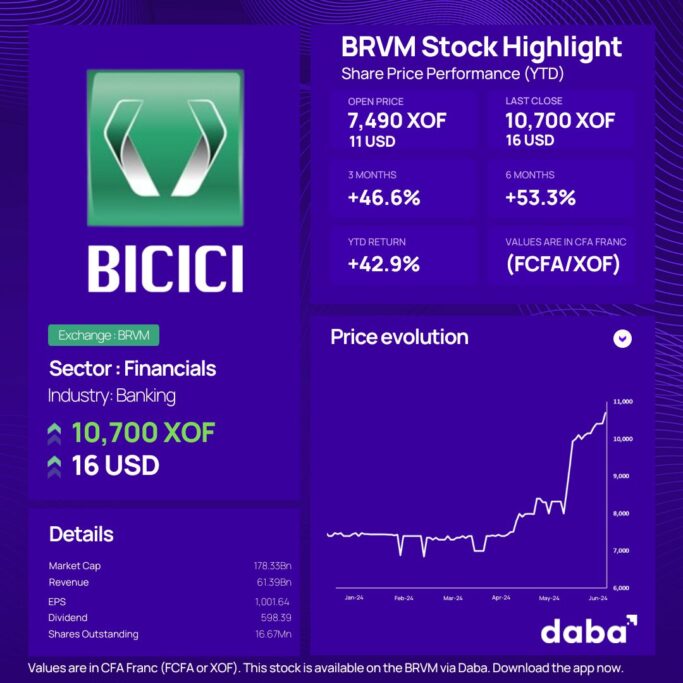

Adopter l’Opportunité Africaine

À mesure que l’écosystème des startups africaines continue de mûrir, les investisseurs qui peuvent utiliser efficacement ces métriques, tout en comprenant le contexte unique des marchés africains, seront bien positionnés pour identifier et soutenir les entreprises entrepreneuriales les plus prometteuses du continent.

Pour explorer des opportunités d’investissement et tirer parti de métriques et analyses détaillées, visitez la plateforme de Daba dès aujourd’hui et commencez votre parcours vers des investissements de haute qualité en Afrique et sur les marchés émergents.