Contributed by Ajibola Awojobi, founder and CEO of BorderPal.

As the sun rises over Lagos, Adebayo, a young Nigerian fintech entrepreneur, stares at his computer screen. His brow furrowed in concentration and his startup, a mobile money platform to bring financial services to the unbanked, has just secured significant funding from a Silicon Valley venture capital firm. It should be a moment of triumph, but Adebayo feels a gnawing sense of unease. The numbers on his screen tell a troubling story: his company is spending $20 to acquire each new customer, yet the average revenue per user is a mere $7.

Adebayo’s predicament is not unique. Across Africa, fintech startups are grappling with a challenging reality: the cost of customer acquisition often far outweighs the immediate returns. This scenario raises a critical question: Is Africa’s venture capital-backed fintech model sustainable or fundamentally broken?

VCs and the Promise of African Fintech

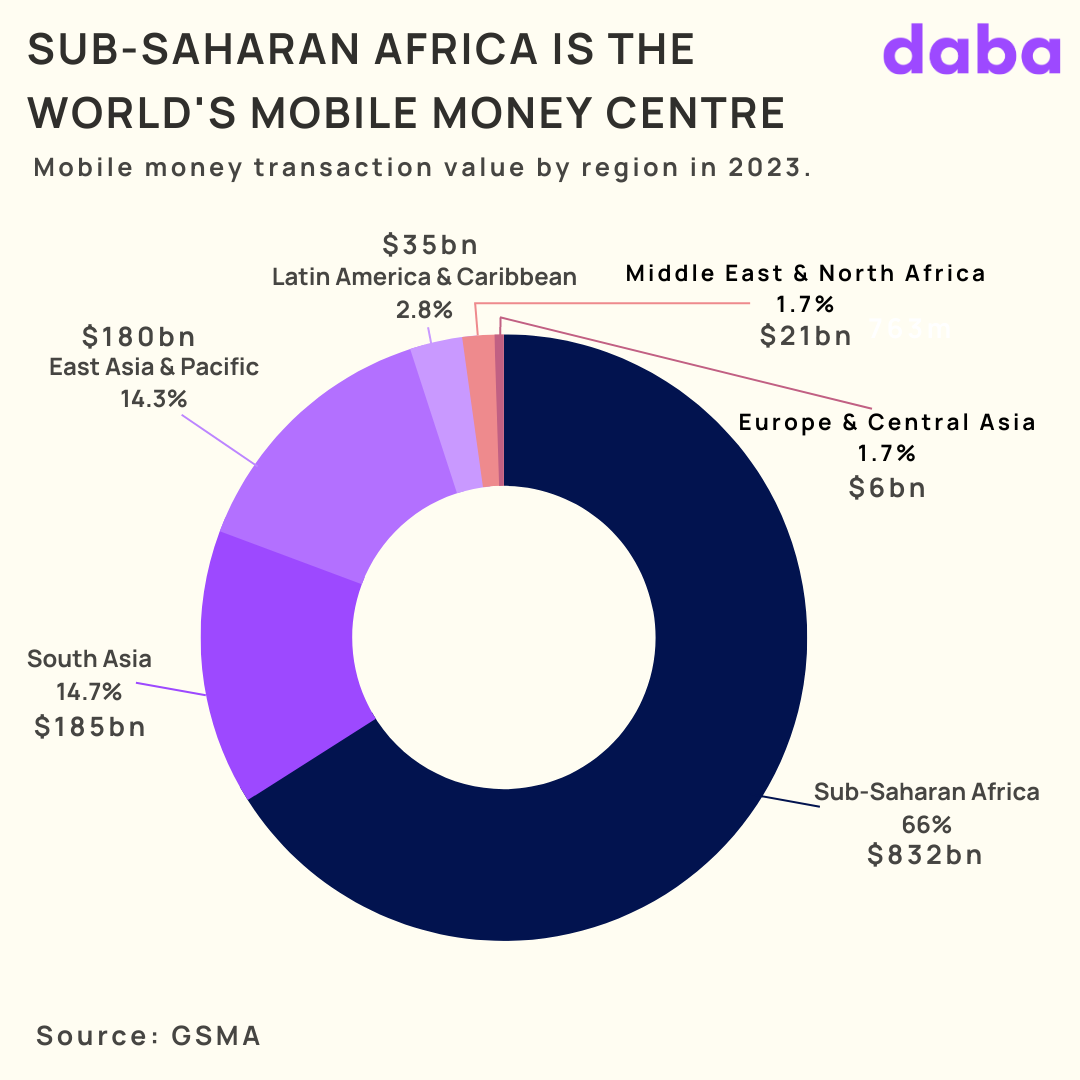

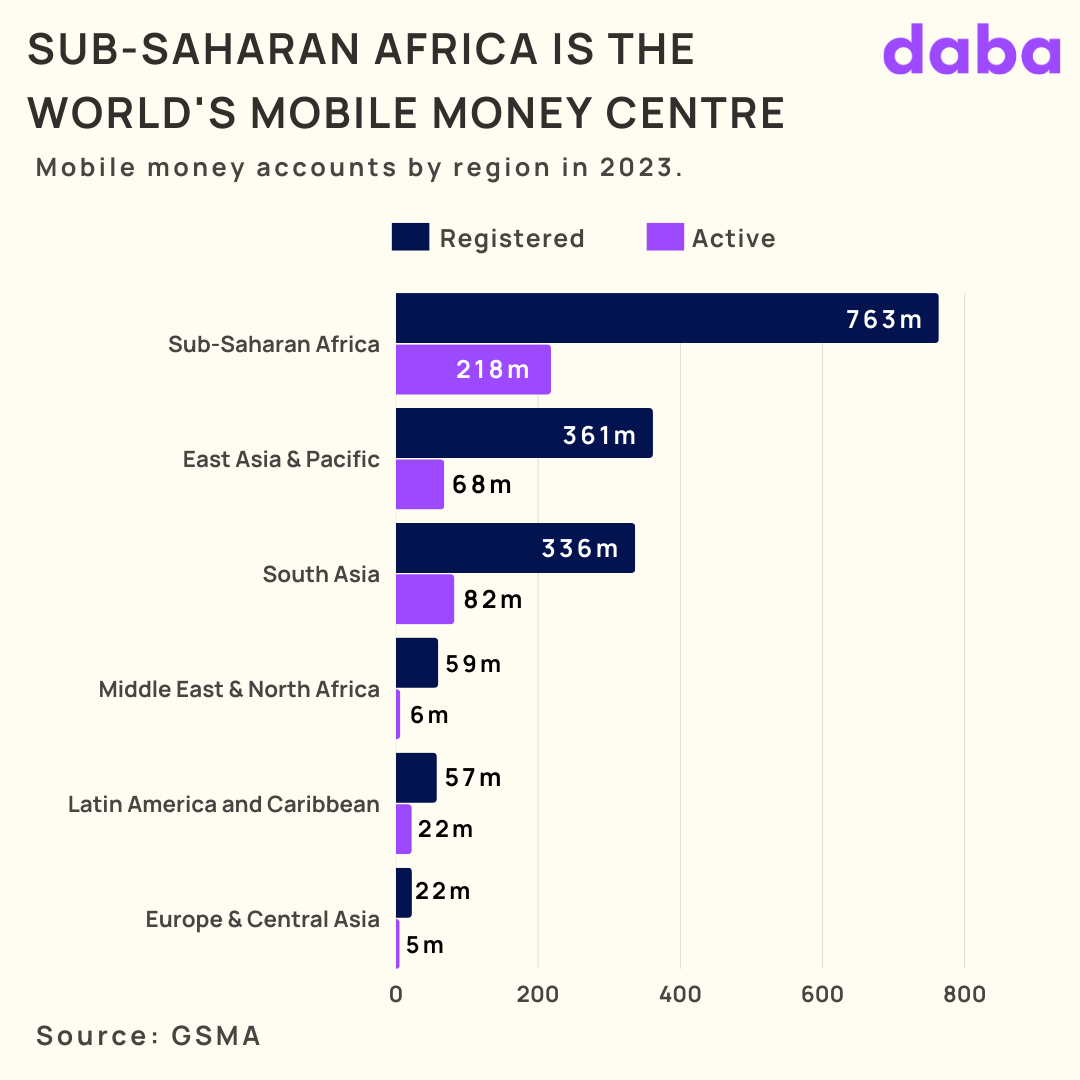

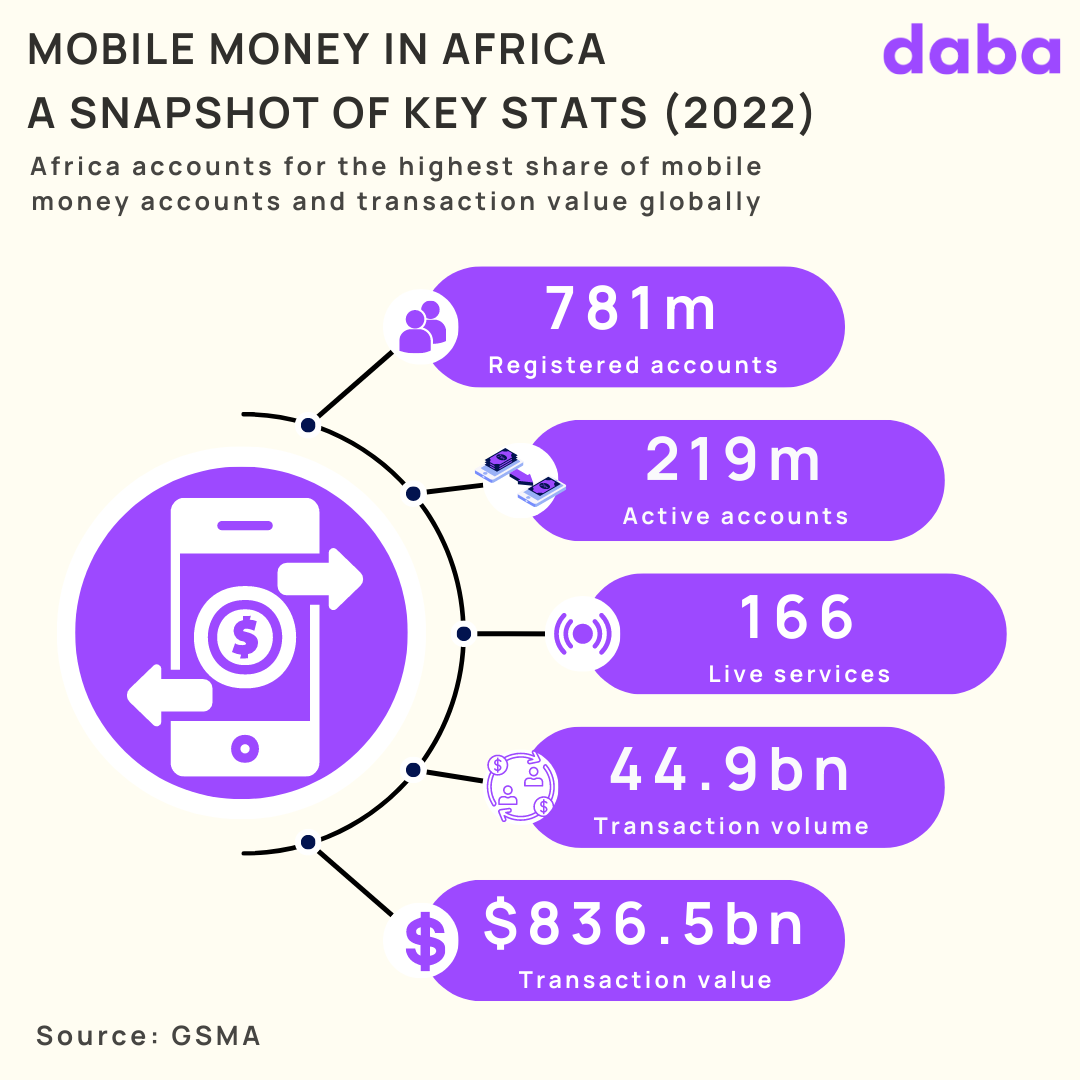

The African continent has long been considered the next frontier for fintech innovation. With a large unbanked population and rapidly increasing mobile phone penetration, the potential for transformative financial services seemed boundless. Venture capitalists, enticed by the prospect of tapping into a market of over a billion people—half without any formal bank account—have poured billions of dollars into African fintech startups over the past decade.

These investments have fueled remarkable innovations. From mobile money platforms that allow users to send and receive funds with a simple text message, to AI-powered credit scoring systems that enable microloans for small businesses, African fintechs have been at the forefront of financial inclusion efforts.

However, as Adebayo’s experience illustrates, translating these innovations into sustainable businesses has proven to be a formidable challenge.

While Adebayo grapples with his early-stage startup’s challenges, a major African fintech player with a customer base of 300,000 users has just raised a mammoth $150 million, which brings its total funding to nearly $600 million. Based on a customer acquisition cost and revenue per customer established earlier, the economics of this deal seem precarious at best. A quick calculation reveals that the company would have spent around $6 million just to acquire its current user base while generating only $2.1 million. The funding, while impressive, thus raises serious questions about the sustainability of this model and the investors’ expectations.

These scenarios serve as a stark illustration of the broader challenges facing the African fintech sector. It highlights the disconnect between the vast sums of venture capital flowing into the industry and the on-the-ground realities of customer acquisition and revenue generation. For a company to justify such a massive investment, it would need to dramatically increase its user base, significantly reduce its customer acquisition costs, or find ways to generate substantially more revenue per user. Achieving any one of these goals in the complex African market is a tall order; achieving all three simultaneously is unarguably a Herculean task.

The funding also underscores the potential for overvaluation in the African fintech space. While such large investments can provide companies with the runway needed to scale and innovate, they also create immense pressure to deliver returns that may not be realistic given the current state of the market. This pressure could lead to unsustainable growth strategies, prioritizing user acquisition over building a solid economic foundation.

Balancing Profitability & Cost of Growth

The core of the problem lies in the high cost of customer acquisition. According to a McKinsey analysis, some fintech companies in Africa spend up to $20 to onboard a single customer, only to generate $7 in revenue from that customer. This imbalance is staggering and points to deeper structural issues in the market.

Several factors contribute to these high acquisition costs. First, there’s the challenge of digital literacy. Many potential customers, particularly those in rural areas, are unfamiliar with digital financial services. This necessitates extensive education and handholding, driving up the cost of onboarding.

Secondly, Africa’s diverse linguistic and cultural landscape requires tailored marketing approaches for different regions. A strategy that works in urban Lagos may fall flat in rural Tanzania, forcing companies to invest heavily in localized marketing efforts.

Infrastructure challenges also play a significant role. The lack of robust digital infrastructure in many African countries is partly responsible for the high customer acquisition costs. Poor internet connectivity, limited smartphone penetration, and unreliable power supply in some areas make digital onboarding processes more difficult and expensive. Moreover, many consumers are wary of new financial services, requiring significant investments in building trust and credibility.

The high customer acquisition costs are reflected in the overall profitability of digital banks globally. A BCG Consulting analysis revealed that only 13 out of 249 digital banks worldwide, or 5%, are profitable, with 10 of those firms being in the Asia Pacific region. This statistic underscores the challenges digital banks face, particularly in emerging markets like Africa.

This reality presents a conundrum for venture capital firms accustomed to the rapid scaling and quick returns seen in other tech sectors. The traditional VC model, focusing on exponential growth and relatively short investment horizons, may not be well-suited to the realities of building sustainable financial services in Africa.

Rethinking the Model

As awareness of these challenges grows, both entrepreneurs and investors need to rethink their approaches to fintech in Africa, taking into consideration the high cost of acquiring customers and the state of the continent’s digital infrastructure.

One promising avenue is the development of white-label infrastructure. By creating common technological solutions that can be customized and branded by different companies, fintechs can significantly reduce their development costs. This approach could be particularly effective for services like Know Your Customer (KYC) systems or payment processing platforms.

Taking the white-label concept further, an innovative solution is emerging: white-labeled services provided by community leaders with large networks in rural settings. This approach could help fintechs lower the cost of building their customer base. By leveraging the trust and influence of local leaders, companies can reduce the cost of onboarding and education. Word of mouth spreads faster in close-knit communities, potentially accelerating adoption rates and lowering acquisition costs.

Partnerships with established institutions are another strategy gaining traction. By collaborating with banks, telecom companies, or large retailers, fintech startups can leverage existing customer bases and distribution networks, potentially lowering acquisition costs.

Some companies are shifting their focus from B2C to B2B services. Targeting businesses rather than individual consumers could lead to lower acquisition costs and higher average revenue per user. For instance, providing payment processing services to small businesses or offering financial management tools to cooperatives could be more cost-effective than trying to onboard individual users one by one.

There’s also growing interest in impact-focused investment models. These approaches prioritize long-term social impact alongside financial returns, potentially allowing for longer runways and more sustainable growth strategies. Such models might be better suited to the realities of building financial infrastructure in emerging markets.

What Does the Future Hold?

As Adebayo contemplates his startup’s future, he realizes the path forward will require a delicate balance between growth and sustainability. The dream of bringing financial services to millions of unbanked Africans remains as compelling as ever, but the route to achieving that dream may need to be recalibrated.

The future of African fintech likely lies in a more nuanced approach to growth and funding. Rather than pursuing rapid scaling at all costs, successful companies must focus on building sustainable unit economics from the ground up. This might mean slower growth in the short term, but it could lead to more robust and impactful companies in the long run.

This shift may require adjusting their expectations and investment strategies for venture capital firms. Longer investment horizons, more hands-on operational support, and a greater focus on a path to profitability rather than just user growth could become the norm.

The story of African fintech is far from over. The potential for transformative impact remains enormous, and the ingenuity and determination of entrepreneurs like Adebayo continue to drive innovation across the continent.

However, realizing this potential will require a reimagining of the current VC-fintech model. By addressing the challenges of high customer acquisition costs, exploring alternative business models, and fostering more supportive regulatory environments, the industry can evolve into a more sustainable and impactful force for financial inclusion.

As the sun sets on another day of hustle and innovation in Africa’s tech hubs, one thing is clear: the future of fintech on the continent will be shaped not just by technological breakthroughs, but by the ability to create sustainable, profitable businesses that truly serve the needs of Africa’s diverse populations. It’s a challenge that will require patience, creativity, and a willingness to rethink established models – but for those who succeed, the rewards could be transformative, not just for their businesses, but for millions of Africans seeking access to vital financial services.

This article was contributed by Ajibola Awojobi, Founder & CEO of BorderPal.