Plus d’un tiers des 50 pays devant organiser des élections cette année se trouvent en Afrique.

Cette année sera un record en termes d’élections.

Au niveau mondial, plus de 2 milliards d’électeurs dans 50 pays se rendront aux urnes, selon le Center for American Progress, un institut de politique américain.

Les États-Unis, l’Inde et le Mexique font partie des pays qui tiendront des élections nationales en 2024.

Plus d’un tiers de ces pays, soit plus de 300 millions de personnes, se trouvent en Afrique.

Les élections les plus attendues en Afrique auront lieu dans l’économie la plus industrialisée du continent et dans une nation majeure d’Afrique de l’Ouest.

Ces votes, en Afrique du Sud et au Sénégal, font partie des 19 élections prévues en Afrique cette année, représentant également plus d’un tiers du continent.

La liste inclut également les pays touchés par un coup d’État que sont le Mali, le Tchad et le Burkina Faso, si les dirigeants de la junte de ces pays restent fidèles à leur parole.

Nous donnons ci-dessous un bref aperçu des pays concernés et des enjeux pour certains d’entre eux.

1. Sénégal

Le Sénégal, une nation à l’extrémité ouest de l’Afrique, compte une population de 18 millions de personnes. L’élection présidentielle à venir, prévue pour le 25 février, suscite une attention considérable tant au niveau national qu’international.

Le président Macky Sall, qui a remporté sa première élection en 2012, s’est adressé à la nation lors de son discours du Nouvel An, soulignant la nécessité d’élections pacifiques après une année turbulente marquée par des violences politiques.

L’année précédente a été marquée par des manifestations d’opposition ferventes, avec le maire de Ziguinchor, Ousmane Sonko, faisant face à des défis juridiques ayant entraîné son emprisonnement en juillet.

Malgré les tentatives des autorités de contrecarrer la candidature de Sonko en interdisant une cérémonie de déclaration formelle, lui et ses partisans ont réussi à organiser un événement en ligne sur Facebook le 31 décembre.

Les observateurs internationaux et les analystes politiques africains expriment des inquiétudes, notant que le Sénégal, autrefois considéré comme un bastion de stabilité en Afrique de l’Ouest, semble naviguer sur un chemin précaire pour son avenir démocratique.

2. Mali

Avec une population de 23,6 millions d’habitants, le Mali se prépare à des élections présidentielles prévues en février. Le pays a connu un coup d’État militaire en 2021, conduisant à la mise en place d’un gouvernement militaire engagé à rendre le pouvoir aux civils. Cependant, des retards répétés dans la programmation des élections présidentielles ont suscité des interrogations.

Initialement fixés aux 4 et 18 février, les scrutins ont connu des revers, attribués à des problèmes techniques et à un différend avec Idemia, une entreprise française responsable des passeports biométriques et des bases de données d’état civil. En juin, les électeurs ont approuvé une nouvelle constitution, une condition préalable à la tenue des élections. Néanmoins, des inquiétudes persistent parmi l’opposition et la société civile, craignant l’enracinement potentiel de l’influence militaire à travers la nouvelle constitution.

3. Afrique du Sud

Célébrant 30 ans de démocratie, l’Afrique du Sud, avec une population de 60,7 millions d’habitants, se prépare à des élections parlementaires prévues entre mai et août. Les élections de 2024 pourraient marquer un tournant significatif, car le Congrès national africain (ANC), le parti de Nelson Mandela, court le risque de perdre un vote national pour la première fois depuis la fin de l’apartheid.

Les vulnérabilités de l’ANC comprennent des défis économiques, un chômage élevé, des promesses d’infrastructures non tenues, un creusement des inégalités et des accusations de corruption. Le paysage politique devient plus concurrentiel, signalant un potentiel changement dans la dynamique politique du pays.

4. Rwanda

Le Rwanda, avec une population de 14,3 millions d’habitants, devrait organiser des élections présidentielles et parlementaires le 15 juillet. Le président actuel Paul Kagame, au pouvoir depuis trois décennies, cherche à prolonger son mandat.

La période de campagne électorale s’étend du 22 juin au 12 juillet, mais Kagame, historiquement réélu avec plus de 90% des voix, fait face à une concurrence minimale. Le chef du Parti vert, Frank Habineza, est le seul adversaire connu à ce jour.

5. Tchad

Avec une population de 18,6 millions d’habitants, le Tchad prévoit une élection présidentielle en octobre. Suite à un récent référendum constitutionnel à la mi-décembre, le leader de la transition, Mahamat Idriss Déby Itno, a nommé Success Masra, un ancien chef de l’opposition, au poste de Premier ministre pour organiser les élections à venir.

Initialement engagé dans une transition de 18 mois vers des élections, le gouvernement de Déby a prolongé le délai jusqu’en 2024, lui permettant de se présenter à la présidence. Les groupes d’opposition avaient appelé au boycott du référendum, citant des préoccupations concernant l’influence de la junte sur le processus.

6. Tunisie

La Tunisie, qui compte 12,5 millions d’habitants, devrait organiser des élections présidentielles en octobre

Le président actuel Kais Saied, élu en 2021, a accru ses pouvoirs et est candidat à la réélection. Les élections locales en janvier, y compris la sélection d’un nouveau Conseil régional créé récemment, serviront de test pour l’opposition, qui revendique une marginalisation par le régime.

Bien que Saied soit prévu pour remporter la victoire, une crise économique croissante, marquée par l’inflation et le chômage, constitue un défi important pour sa campagne en vue d’un éventuel second mandat.

7. Ghana

Le Ghana, avec une population de 34,4 millions d’habitants, se prépare à des élections présidentielles et parlementaires le 7 décembre.

Le président sortant Nana Akufo-Addo, arrivant au terme de deux mandats, se retire, et le Parti patriotique national au pouvoir vise un troisième mandat consécutif sans précédent.

Le vice-président Mahamudu Bawumia a obtenu la nomination présidentielle du parti au pouvoir, préparant la scène pour une confrontation avec le candidat du Congrès démocratique national de l’opposition, l’ancien président John Dramani Mahama.

Les défis économiques, dont une dette substantielle, exacerbent l’incertitude entourant les élections au Ghana.

8. Algérie

L’Algérie, avec une population de 46 millions d’habitants, prévoit des élections présidentielles en décembre. Abdelmadjid Tebboune, au pouvoir depuis quatre ans, a succédé à Abdelaziz Bouteflika, destitué en avril 2019 suite à des manifestations contre sa candidature à un cinquième mandat. Le vote de 2019, lié à Bouteflika, a fait l’objet de boycotts généralisés.

Le mouvement du Hirak, instrumental dans la destitution de Bouteflika, a diminué depuis la période de la COVID-19. Malgré cela, l’Algérie affiche un taux de croissance de 4,2%, d’importantes réserves de change et d’impressionnantes exportations non pétrolières, contrecarrant la tendance plus large en Afrique.

9. Comores

Avec une population de 860 000 habitants, les Comores se préparent à des élections présidentielles le 14 janvier.

10. Togo

En anticipant des élections parlementaires début 2024, le Togo, avec une population de 9,2 millions d’habitants, est sur le point de vivre une transition politique.

11. Mauritanie

La Mauritanie, qui compte 4,9 millions d’habitants, devrait organiser des élections présidentielles le 22 juin. Le processus électoral jouera un rôle crucial dans la formation du paysage politique du pays.

12. Mozambique

Le Mozambique, avec une population de 34,4 millions d’habitants, est programmé pour les élections présidentielles et de l’Assemblée de la République le 9 octobre. Les résultats électoraux influenceront la gouvernance et l’orientation politique de la nation.

13. Botswana

Le Botswana, avec une population de 2,7 millions d’habitants, prévoit des élections parlementaires en octobre. Le paysage politique de cette nation stable d’Afrique australe est en attente de changements potentiels.

14. Soudan du Sud

Le Soudan du Sud, qui compte 11,2 millions d’habitants, prévoit des élections présidentielles et parlementaires en décembre. Les élections surviennent dans un contexte de défis, dont les troubles économiques et l’impact plus large de la pandémie mondiale et de la guerre Russie-Ukraine.

15. Madagascar

Madagascar, avec une population de 30,7 millions d’habitants, se prépare à des élections parlementaires prévues en mai. La dynamique politique de cette île de l’océan Indien sera scrutée pendant ce processus électoral.

Dates à annoncer :

16. Burkina Faso

Avec une population de 22 millions d’habitants, le Burkina Faso est sous la domination d’une junte dirigée par le capitaine Ibrahim Traoré depuis 2022. La junte promet un retour à la démocratie avec des élections présidentielles provisoirement prévues pour juillet 2024. Cependant, l’augmentation des attaques djihadistes peut remettre en question le calendrier, suscitant des incertitudes quant aux élections.

17. Maurice

Maurice, avec une population de 1,3 million d’habitants, se prépare à des élections parlementaires. Le paysage politique de cette île de l’océan Indien devrait connaître des changements à travers ce processus électoral.

18. Namibie

La Namibie, avec une population de 2,6 millions d’habitants, prévoit des élections présidentielles et parlementaires. Les résultats électoraux influenceront la gouvernance et les politiques de cette nation d’Afrique australe.

19. Guinée-Bissau

Avec une population de 2,2 millions d’habitants, la Guinée-Bissau se prépare à une élection présidentielle. Les développements politiques dans cette nation d’Afrique de l’Ouest seront étroitement surveillés tant sur le plan régional qu’international.

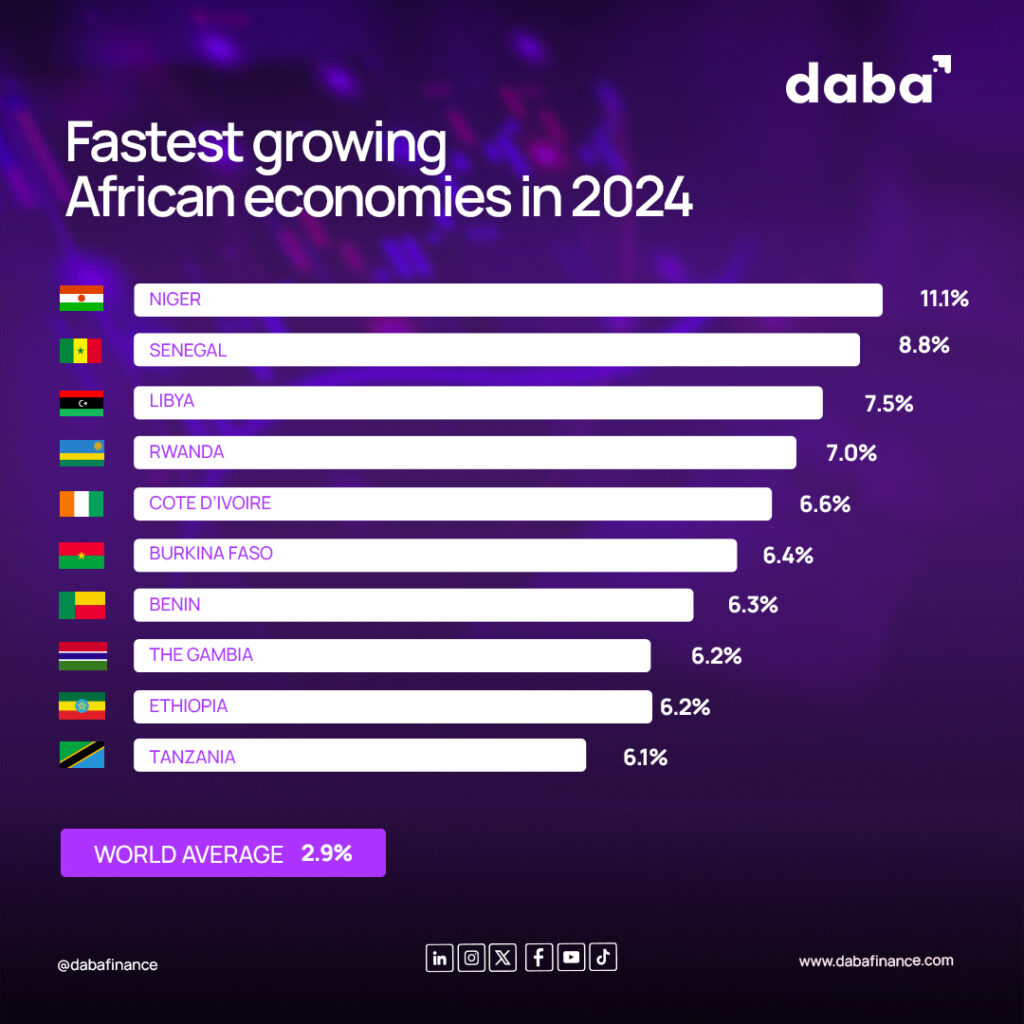

Malgré l’instabilité politique dans certaines régions de l’Afrique, le continent devrait être la deuxième région à la croissance la plus rapide en 2024, après l’Asie, selon l’Unité de renseignement économique de The Economist.

De plus, sept des dix économies connaissant la croissance la plus rapide au niveau mondial cette année, comme prédit par le FMI, se trouvent en Afrique.