Par l’équipe Daba – Le leader de l’investissement digital en Afrique

Introduction : Pourquoi la BRVM attire de plus en plus d’investisseurs

Investir à la BRVM (Bourse Régionale des Valeurs Mobilières) n’est plus réservé à une élite. C’est aujourd’hui une opportunité ouverte à tous ceux qui souhaitent faire fructifier leur argent en Afrique de l’Ouest, avec transparence, régulation, et potentiel de rendement élevé.

Cette bourse commune à 8 pays de l’UEMOA (dont la Côte d’Ivoire, le Sénégal, le Burkina Faso, etc.) est unique en son genre, avec une monnaie stable (le franc CFA, arrimé à l’euro) et une architecture entièrement digitalisée.

Avec l’application Daba Finance, il est désormais possible d’ouvrir un compte, acheter des actions, suivre l’actualité boursière, et investir intelligemment dès 10 000 FCFA.

Et pour ceux qui débutent, l’Académie du Patrimoine de Daba offre un parcours guidé pour comprendre et maîtriser l’investissement à la BRVM.

1. Comprendre les bases de l’investissement à la BRVM

Avant d’investir, il est essentiel de connaître quelques principes clés :

- La BRVM est un marché réglementé, où seules les entreprises solides et respectant des normes strictes peuvent être cotées.

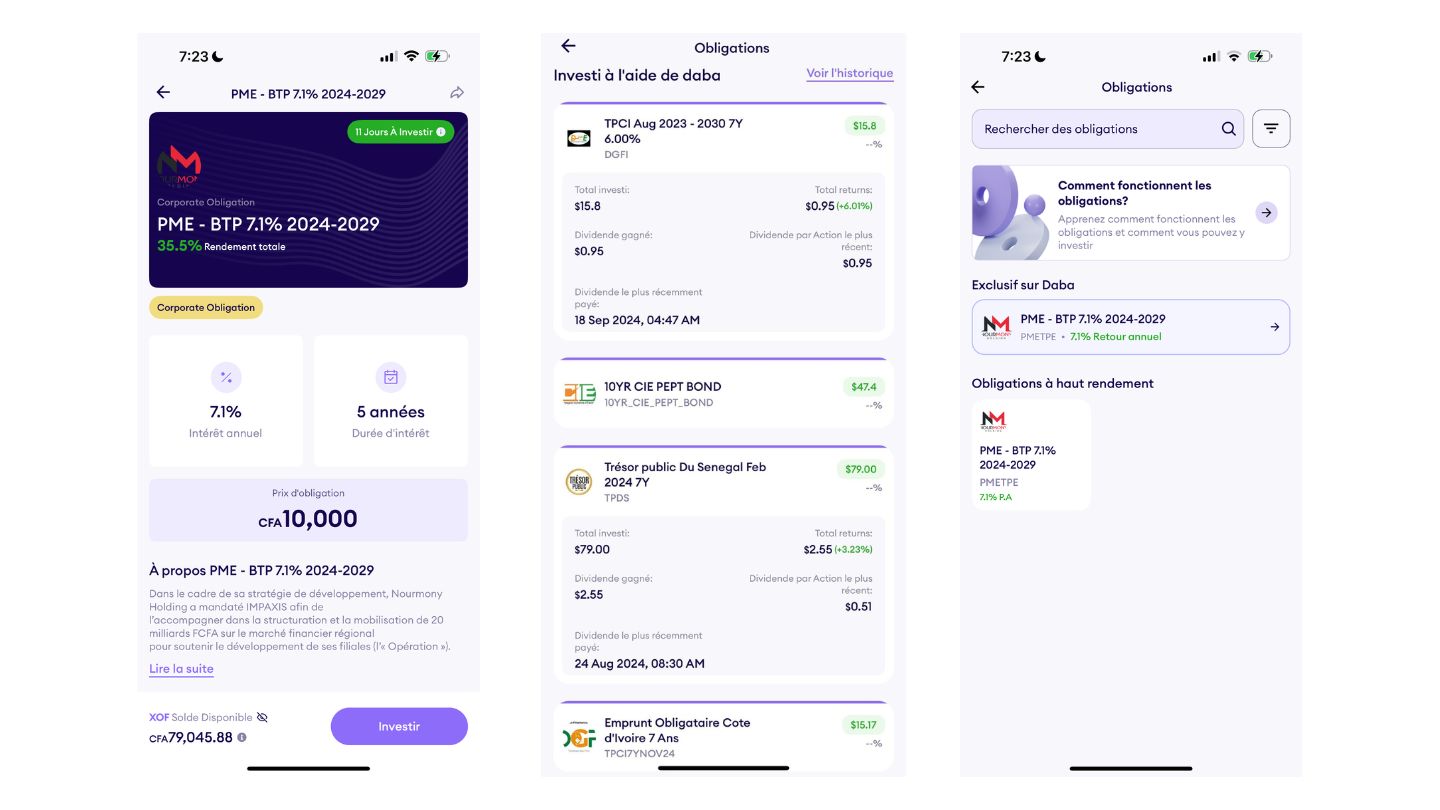

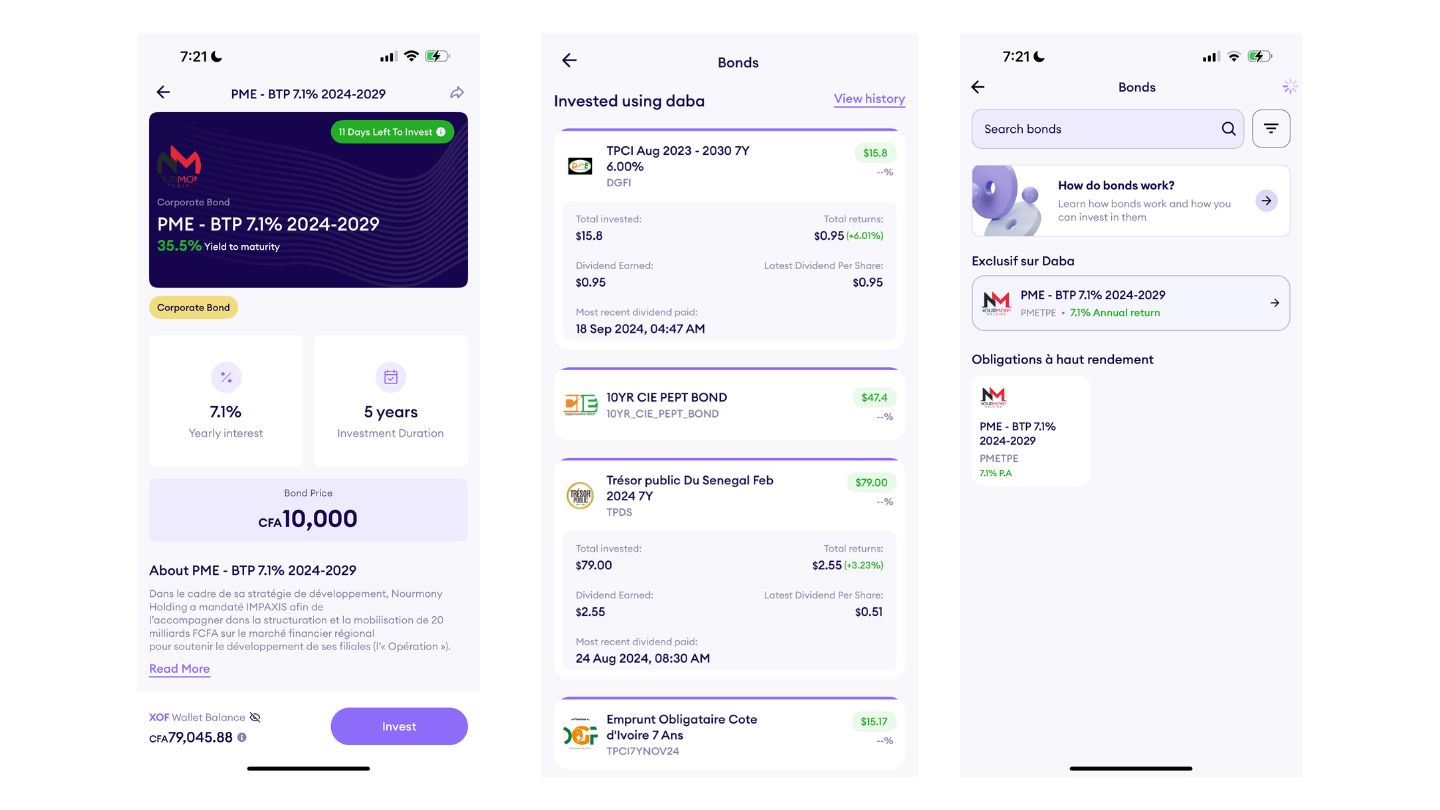

- Vous pouvez y acheter des actions (parts d’entreprises) ou des obligations (prêts faits à ces entreprises ou à des États).

- Les investisseurs peuvent espérer des dividendes réguliers, ainsi qu’une plus-value si la valeur de l’action augmente.

- C’est un investissement à moyen ou long terme, parfait pour se constituer un patrimoine, préparer sa retraite ou financer les études de ses enfants.

2. Étapes pour investir à la BRVM

Voici un parcours simple et sécurisé, accessible à tous avec Daba :

a) Ouvrir un compte titres

Traditionnellement, cela se faisait auprès d’un SGI (Société de Gestion et d’Intermédiation). Mais aujourd’hui, avec Daba Finance, ce processus est entièrement digitalisé. En quelques clics, vous ouvrez votre compte directement depuis votre téléphone.

b) Approvisionner votre portefeuille

Vous déposez de l’argent via mobile money ou virement bancaire. L’argent sera utilisé pour acheter des actions ou obligations.

c) Choisir vos investissements

Avec Daba, vous accédez à :

- Des analyses sur les meilleures actions à acheter

- Des collections thématiques (télécoms, banques, agro-industrie, etc.)

- Des recommandations via Daba Pro pour investir comme un pro, même en étant débutant.

d) Suivre vos performances

Depuis l’app, suivez l’évolution de votre portefeuille, recevez vos dividendes et consultez les nouvelles financières du marché.

e) Retirer vos gains

Les actions sont liquides : vous pouvez revendre tout ou partie de vos titres à tout moment et retirer vos fonds via Daba.

3. Pourquoi investir à la BRVM ? Les avantages concrets

Investir à la BRVM avec Daba présente de nombreux avantages :

✅ Un potentiel de rendement élevé : certaines entreprises cotées offrent plus de 8 % de rendement en dividendes par an.

✅ Un marché en croissance : l’économie ouest-africaine croît en moyenne de 6 à 7 % par an, soutenant la valorisation des entreprises cotées.

✅ Un investissement local : vous participez à l’essor de votre région en finançant des entreprises africaines solides.

✅ Accessibilité : vous pouvez commencer avec seulement 10 000 FCFA, sans avoir besoin d’être un expert en finance.

✅ Simplicité avec Daba : tout se fait en ligne, sans paperasse ni déplacements, avec une interface claire et intuitive.

✅ Liquidité : contrairement à l’immobilier ou aux tontines, vous pouvez vendre vos actions quand vous voulez.

4. Apprendre à investir avec l’Académie du Patrimoine

Vous êtes débutant et ne savez pas par où commencer ? L’Académie du Patrimoine de Daba est votre meilleur allié. Elle propose :

- Une formation complète sur la BRVM, disponible en ligne 24h/24, même sur mobile

- 24 modules interactifs : de la découverte de la bourse à la sélection d’actions gagnantes

- Des formateurs expérimentés et des ressources créées par des experts en investissement

- Un accompagnement personnalisé : vous pouvez poser vos questions et échanger avec la communauté Daba

- Bonus de 5 000 FCFA pour investir offert avec l’inscription

💬 Ce que disent nos apprenants :

« Même sans background en finance, j’ai vite compris et commencé à investir avec confiance. » – Hamadou Bouba, entrepreneur

L’Académie est idéale pour toute personne qui souhaite apprendre pas à pas, sans jargon compliqué.

5. Les erreurs à éviter quand on débute

Même si la BRVM est une opportunité accessible, voici quelques pièges courants à éviter :

- Investir sans comprendre : ne suivez pas la foule ou les rumeurs. Utilisez les contenus de Daba Pro ou suivez l’Académie pour faire des choix éclairés.

- Mettre tout son argent : commencez petit, testez, et augmentez progressivement selon votre stratégie.

- Ignorer les actualités du marché : restez informé grâce au fil d’actualité intégré dans l’app Daba.

- Négliger la diversification : ne mettez pas tout sur une seule entreprise. Daba vous propose des collections de titres pour mieux diversifier.

6. Témoignage : “J’ai doublé mon investissement en 12 mois”

“En décembre 2022, j’ai investi dans une IPO sur la BRVM via Daba. L’action a pris plus de 70 % en un an, en plus de me rapporter des dividendes. C’est là que j’ai compris la puissance de la bourse africaine. Et tout ça, sans quitter mon téléphone.” – K.B., investisseur individuel à Abidjan

Ce type d’opportunité est fréquent sur la BRVM. Encore faut-il y avoir accès… et c’est exactement ce que propose Daba : démocratiser l’investissement en Afrique.

7. Pourquoi utiliser Daba pour investir ?

Daba n’est pas juste une application : c’est une plateforme d’investissement complète, pensée pour l’Afrique, avec :

- Une interface intuitive

- Une ouverture de compte 100 % en ligne

- Des analyses de marché en temps réel

- Des formations intégrées (Daba Academy)

- Des alertes personnalisées sur les meilleures opportunités

- Et un service client disponible et réactif

Plus de 30 000 utilisateurs ont déjà rejoint Daba pour investir dans l’avenir du continent.

Lancez-vous dès aujourd’hui

Investir à la BRVM, c’est investir dans l’avenir de l’Afrique, tout en bâtissant son propre patrimoine. Grâce à Daba Finance et l’Académie du Patrimoine, tout est à portée de main pour passer à l’action dès maintenant — que vous soyez débutant ou expérimenté.

🎯 Commencez aujourd’hui avec seulement 10 000 FCFA 📲 Téléchargez l’app Daba sur iOS ou Android 🎓 Rejoignez la Daba Academy pour apprendre à investir en toute confiance

Liens utiles