Découvrez les principales perspectives du rapport African Economic Outlook 2024 et explorez les opportunités d’investissement dans les régions à croissance rapide du continent.

Le rapport African Economic Outlook 2024, publié par la Banque africaine de développement, présente une analyse complète de la performance économique de l’Afrique et des projections futures.

Le rapport met en évidence la résilience du continent face à de multiples chocs mondiaux et expose des stratégies pour stimuler la transformation structurelle et la croissance durable.

Nous fournissons ci-dessous un aperçu des principales perspectives du rapport et explorons les opportunités d’investissement dans les régions à croissance rapide de l’Afrique.

Points Clés

Résilience Économique et Projections de Croissance

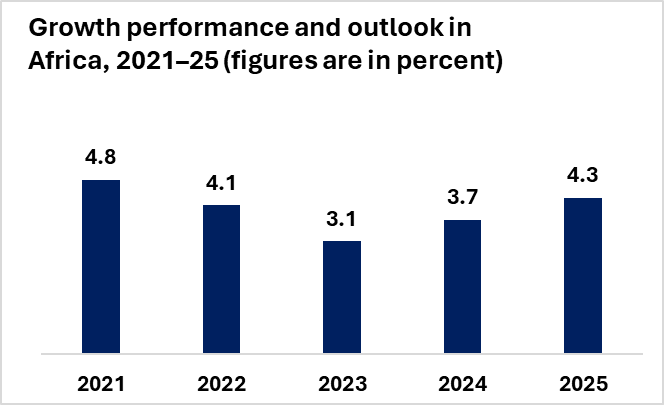

Malgré les prix élevés des denrées alimentaires et de l’énergie, les tensions géopolitiques, les impacts du changement climatique et l’instabilité politique, les économies africaines ont montré une résilience remarquable.

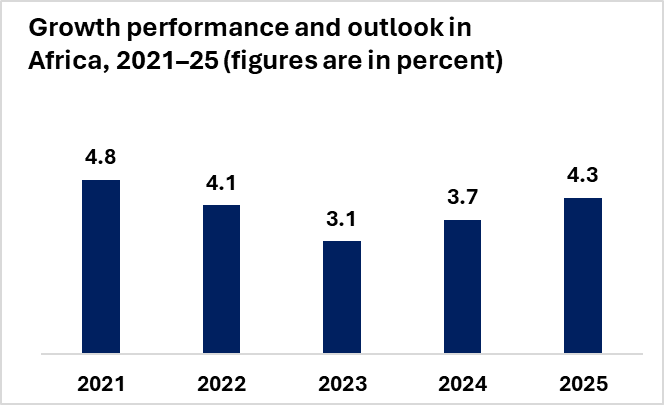

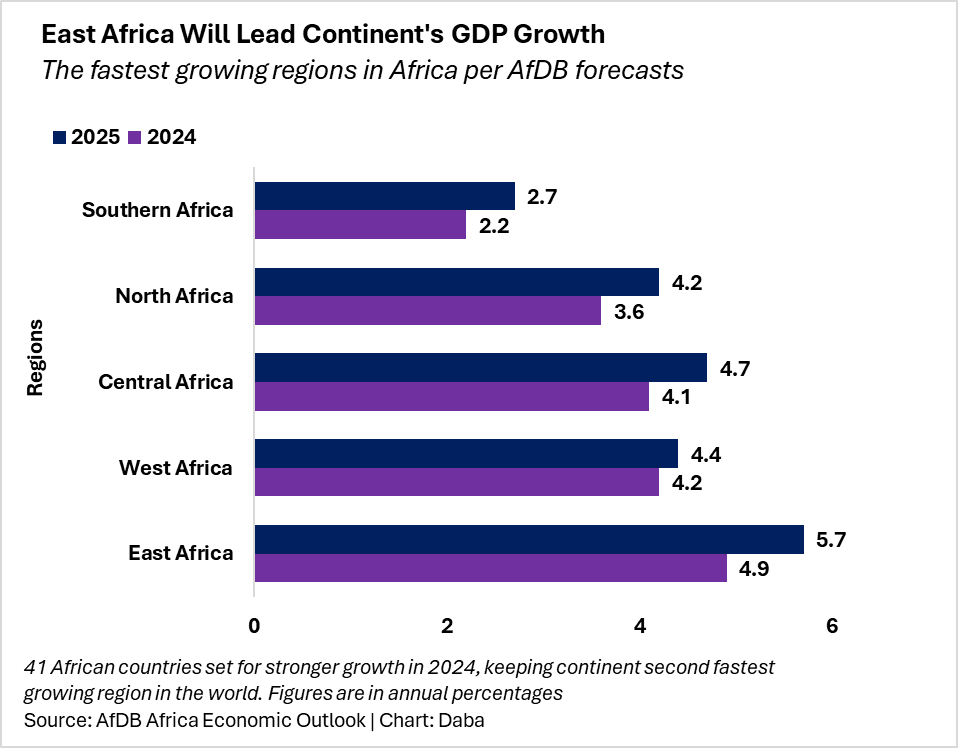

La croissance réelle moyenne du PIB de l’Afrique a ralenti à 3,1 % en 2023 contre 4,1 % en 2022, mais devrait rebondir à 3,7 % en 2024 et 4,3 % en 2025.

Ce rebond souligne la capacité du continent à se redresser et à croître malgré des défis importants.

Performance Sectorielle

La croissance en Afrique est stimulée par des investissements publics accrus dans les secteurs clés et des dépenses importantes en infrastructures publiques critiques.

Les économies non dépendantes des ressources devraient connaître une croissance plus élevée grâce à des activités économiques diversifiées, soulignant l’importance d’investir dans divers secteurs pour soutenir la croissance économique.

Régions à Croissance la Plus Rapide en Afrique

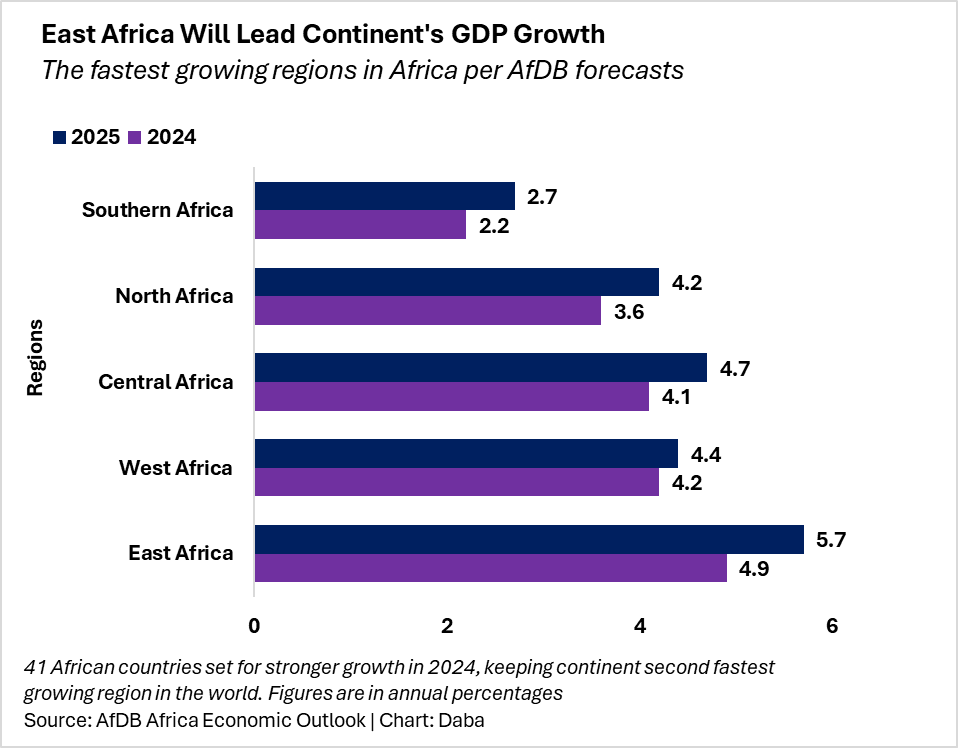

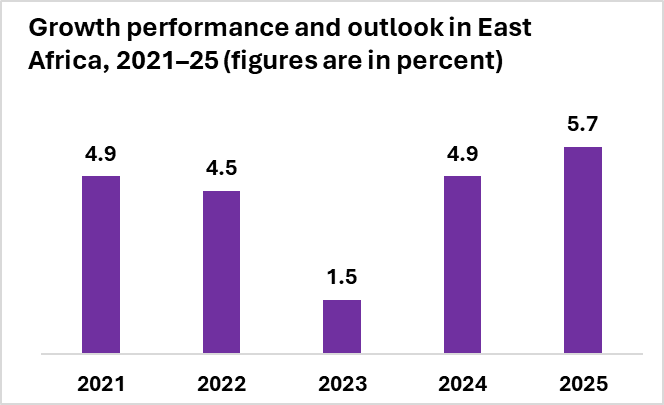

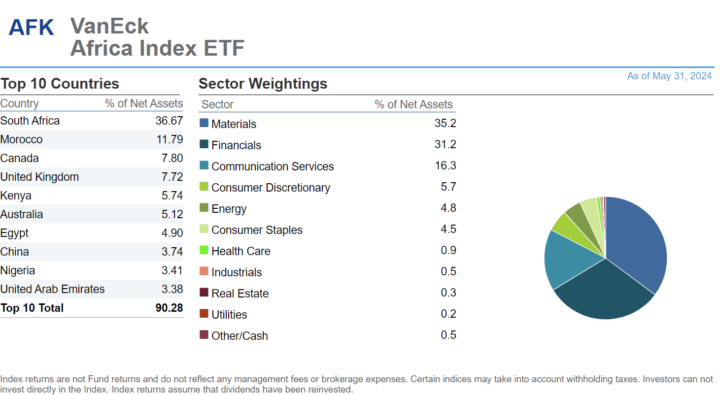

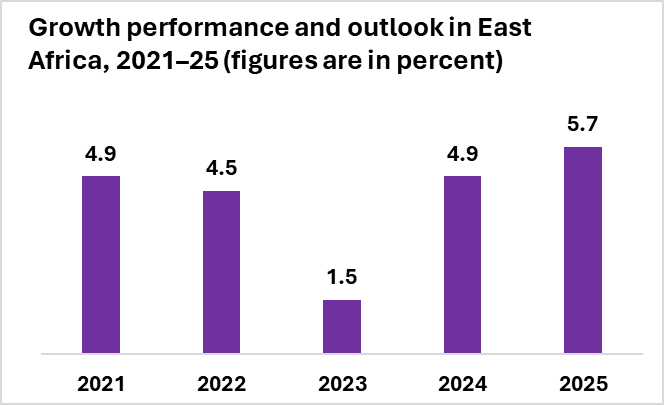

Afrique de l’Est : Leader de la Croissance

Projections de Croissance :

- La région devrait être la plus dynamique, avec une croissance du PIB projetée à 1,5 % en 2023, 4,9 % en 2024 et 5,7 % en 2025.

Opportunités d’Investissement :

- La croissance rapide de l’Afrique de l’Est est alimentée par des investissements accrus dans les infrastructures, la technologie et les services.

- Les investisseurs peuvent explorer des opportunités à la Nairobi Securities Exchange (NSE) et à la Dar es Salaam Stock Exchange (DSE) pour s’exposer à des secteurs prometteurs tels que la technologie, les télécommunications et les services financiers.

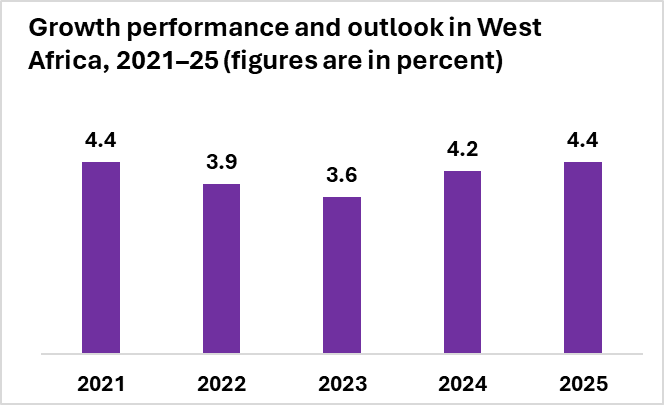

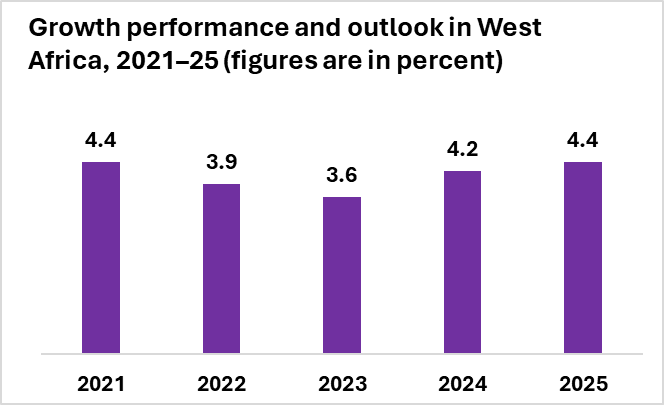

Afrique de l’Ouest : Une Région Prometteuse

Projections de Croissance :

- La croissance devrait passer de 3,6 % en 2023 à 4,2 % en 2024 et 4,4 % en 2025.

Opportunités d’Investissement :

- La croissance de l’Afrique de l’Ouest est soutenue par la solide performance de grandes économies comme la Côte d’Ivoire, le Ghana, le Nigeria et le Sénégal.

- La Bourse Régionale des Valeurs Mobilières (BRVM) est une bourse clé pour les investisseurs souhaitant accéder au marché ouest-africain. La plateforme Daba offre un moyen facile et efficace d’investir dans des actions cotées à la BRVM, offrant une exposition à des entreprises leaders dans des secteurs dynamiques de la région.

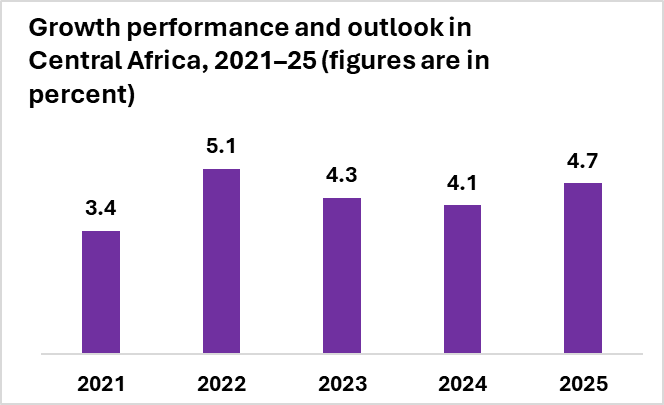

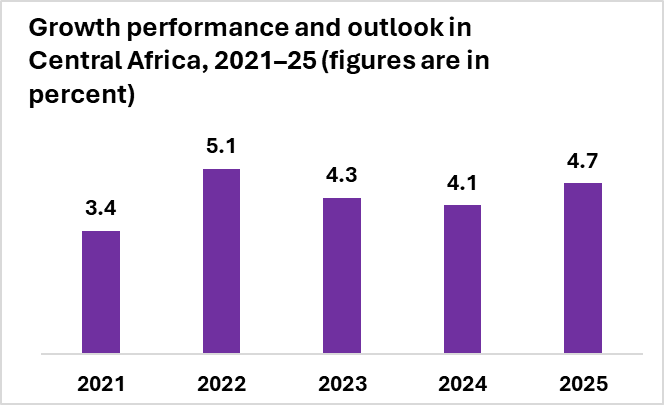

Afrique Centrale : Amélioration Progressive

Projections de Croissance :

- La croissance devrait modérer légèrement mais s’améliorer fortement à 4,7 % d’ici 2025.

Opportunités d’Investissement :

- La croissance de la région est stimulée par des prix favorables des métaux et des investissements accrus dans les mines et les infrastructures.

- Les investisseurs peuvent explorer des opportunités à la Bourse des Valeurs Mobilières de l’Afrique Centrale (BVMAC) pour s’exposer à ces secteurs.

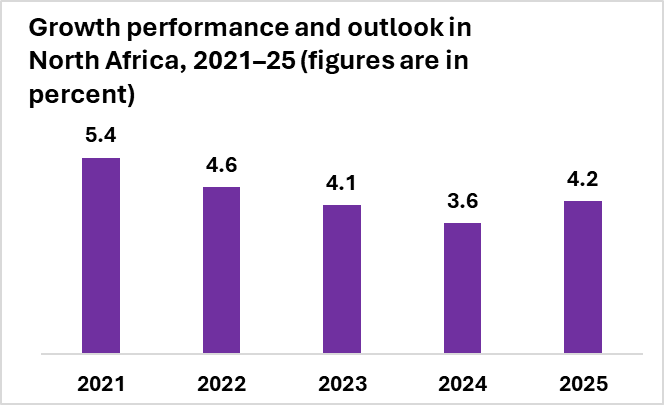

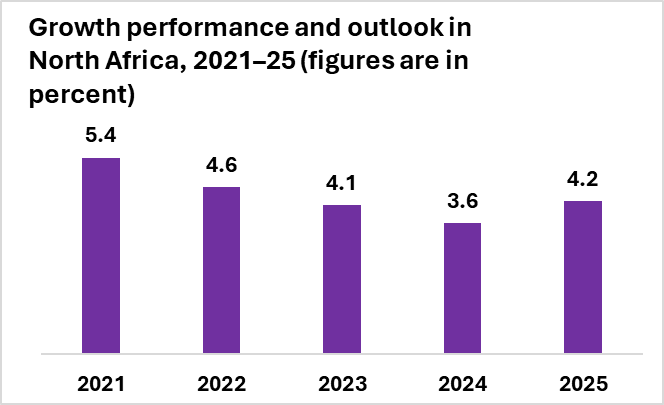

Afrique du Nord : Potentiel Robuste

Projections de Croissance :

- La croissance devrait diminuer légèrement, passant de 4,1 % estimé en 2023 à 3,6 % en 2024, mais devrait rebondir à 4,2 % en 2025.

Opportunités d’Investissement :

- La croissance de l’Afrique du Nord est soutenue par des économies diversifiées, avec de solides performances dans des secteurs tels que le tourisme, la fabrication et l’énergie.

- La Bourse de Casablanca (CSE) et la Bourse Égyptienne (EGX) offrent des opportunités d’investissement robustes dans ces secteurs clés.

- Les secteurs du tourisme et de l’hôtellerie dans des pays comme le Maroc et l’Égypte présentent des perspectives attrayantes pour les investisseurs.

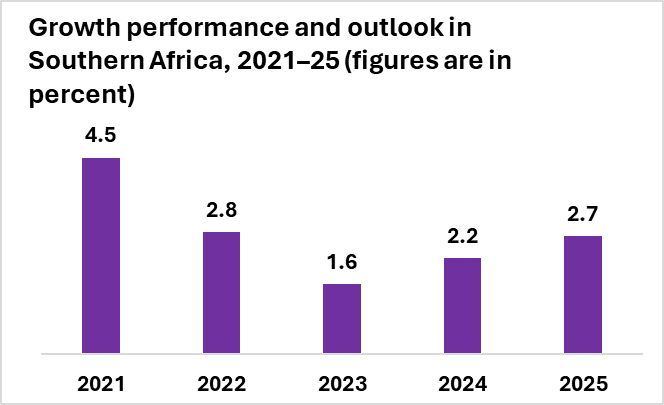

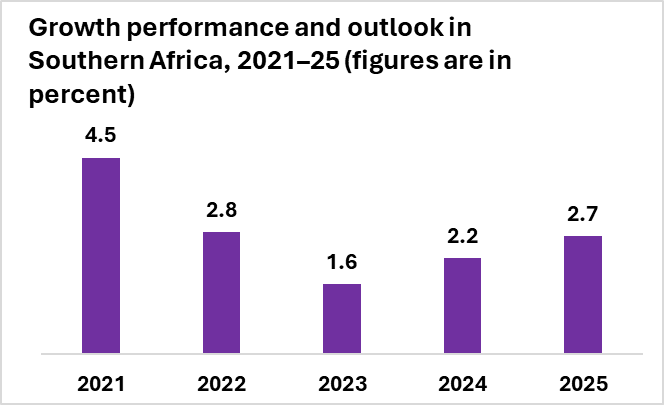

Afrique Australe : Croissance Progressive

Projections de Croissance :

- La croissance devrait augmenter progressivement, passant de 1,6 % estimé en 2023 à 2,2 % en 2024 et à 2,7 % en 2025.

Opportunités d’Investissement :

- La croissance de l’Afrique australe est influencée par des économies majeures comme l’Afrique du Sud, qui connaît une reprise progressive.

- Les investisseurs peuvent explorer des opportunités à la Bourse de Johannesburg (JSE) pour s’exposer à des secteurs tels que les mines, la finance et le commerce de détail.

- L’économie diversifiée de l’Afrique du Sud offre une gamme d’options d’investissement, des industries bien établies aux secteurs émergents.

Inflation et Dynamiques Monétaires

Tendances de l’Inflation :

- L’inflation moyenne en Afrique a augmenté à 17 % en 2023, poussée par la hausse des prix des denrées alimentaires, les surplus de liquidité et la dépréciation des devises.

- L’inflation devrait augmenter à 17,8 % en 2024 avant de se calmer à 12,3 % en 2025.

Dépréciation des Devises :

- De nombreuses devises africaines se sont dépréciées en 2023 en raison des taux d’intérêt mondiaux élevés et des incertitudes économiques. Une dépréciation significative a été observée pour le naira nigérian et le kwanza angolais, affectant la stabilité économique globale.

Équilibres Fiscaux et Extérieurs

Déficits Fiscaux :

- Les déficits fiscaux devraient se réduire, passant de 5 % du PIB en 2023 à 4,3 % d’ici 2025 à mesure que les pays maîtrisent les dépenses et améliorent la mobilisation des recettes.

Déficits du Compte Courant :

- Les déficits moyens du compte courant devraient s’élargir légèrement mais devraient se stabiliser avec l’amélioration des conditions du commerce mondial et de l’économie.

Niveaux d’Endettement :

- La dette publique reste élevée, reflétant le fardeau du service de la dette sur l’espace budgétaire. Le ratio médian de la dette publique devrait diminuer mais rester au-dessus des niveaux pré-pandémiques.

Flux Financiers Extérieurs

Déclin des Flux Financiers Extérieurs :

- Le resserrement des conditions financières mondiales a conduit à une diminution significative des flux financiers extérieurs vers l’Afrique en 2022, affectant les investissements et le financement du développement.

Défis et Opportunités

Principaux Risques à la Baisse :

- Les pressions inflationnistes persistantes, les tensions géopolitiques, les prix élevés des commodités, les conflits régionaux et les chocs climatiques posent des risques à la reprise économique et à la croissance.

Principaux Vents Favorables :

- Les tendances positives en matière de consolidation budgétaire, de transformation structurelle et de conditions de marché mondiales favorables pourraient améliorer les perspectives de croissance.

Recommandations Politiques

Politiques à Court Terme :

- Ajustements de la politique monétaire pour atteindre une désinflation plus rapide.

- Aborder les pressions sur le taux de change et promouvoir la production locale pour stabiliser les prix alimentaires.

- Mettre en œuvre des réformes de gouvernance et renforcer la gestion de la dette pour réduire le fardeau de la dette publique.

Politiques à Moyen et Long Terme :

- Intensifier la mobilisation des ressources nationales pour accélérer la transformation structurelle.

- Réformer l’architecture financière mondiale pour faciliter la restructuration de la dette.

- Créer un environnement propice aux flux financiers extérieurs pour soutenir la transformation économique.

Conclusion

Le rapport African Economic Outlook 2024 souligne la résilience du continent et son potentiel de croissance durable malgré les défis mondiaux.

Les investissements stratégiques dans les infrastructures, le capital humain et les réformes structurelles, associés à une mise en œuvre politique efficace, peuvent conduire la transformation de l’Afrique et améliorer ses perspectives économiques.

Les investisseurs cherchant à tirer parti du potentiel de croissance de l’Afrique peuvent explorer des opportunités dans les régions à croissance rapide du continent, telles que l’Afrique de l’Est et l’Afrique de l’Ouest.

Des plateformes comme l’application Daba offrent un accès pratique à l’investissement dans des actions cotées sur des bourses régionales comme la BRVM, offrant une exposition à des marchés dynamiques et en pleine croissance.

Embrassez l’avenir de la croissance économique de l’Afrique et explorez les nombreuses opportunités d’investissement disponibles sur ce continent résilient et prometteur. Commencez ici.